Giving season is upon us. Every year, Canadians contribute billions of dollars to charity, generously exceeding the $10 billion mark in 2021. With the holiday season approaching, and with the end of the tax year looming, many individuals and families are making their charitable giving decisions for the year.

If you, too, are planning to make charitable donations this year, be sure to consider these best practices and tips to help you maximize your social impact while benefiting from the resulting tax advantages.

Giving is always best when done from a place of altruism, commitment to a cause, or a desire to help. Not sure where to direct your gifts? Start with your own values and consider what drives you. Is it a desire to make a positive social change, to help your local community, or to assist those less fortunate? Perhaps you want to support the arts or education, or you have concerns about the environment. Giving from the heart isn’t just the most personally satisfying way to donate; studies have shown that when donors give to causes they truly care about, they are far more likely to make repeat donations, commit long term, and actively volunteer with organizations in other ways.

For many families, philanthropy is a shared activity and even a treasured generational tradition. Discussing your charitable priorities with younger family members is a great way to connect and demonstrate your values; this may be why philanthropy has been described as “family values in action.” Some families choose to include older children in the charitable decision-making process, giving the next generation a feeling of ownership in the family’s commitment to ”giving back.” There are many online resources to assist you in researching and vetting charitable organizations. Be sure to visit your chosen charity’s ebsite, which should include important details about current fundraising needs, spending priorities, and even audited financial statements.

Take advantage of charitable income tax savings

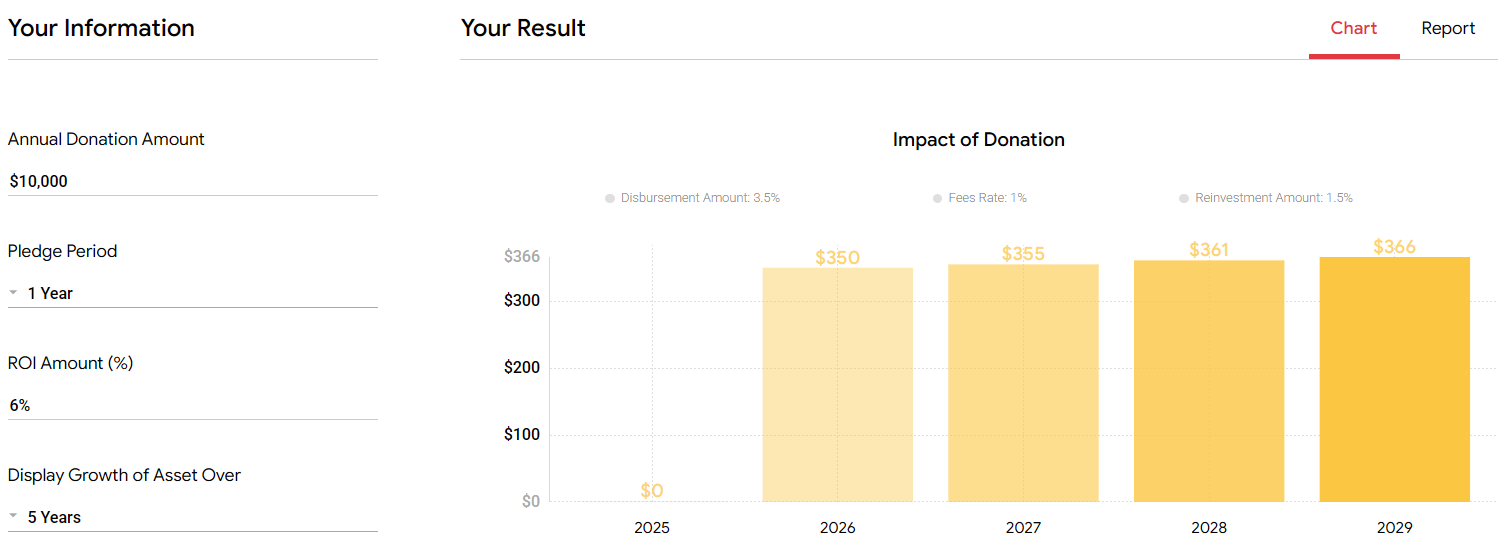

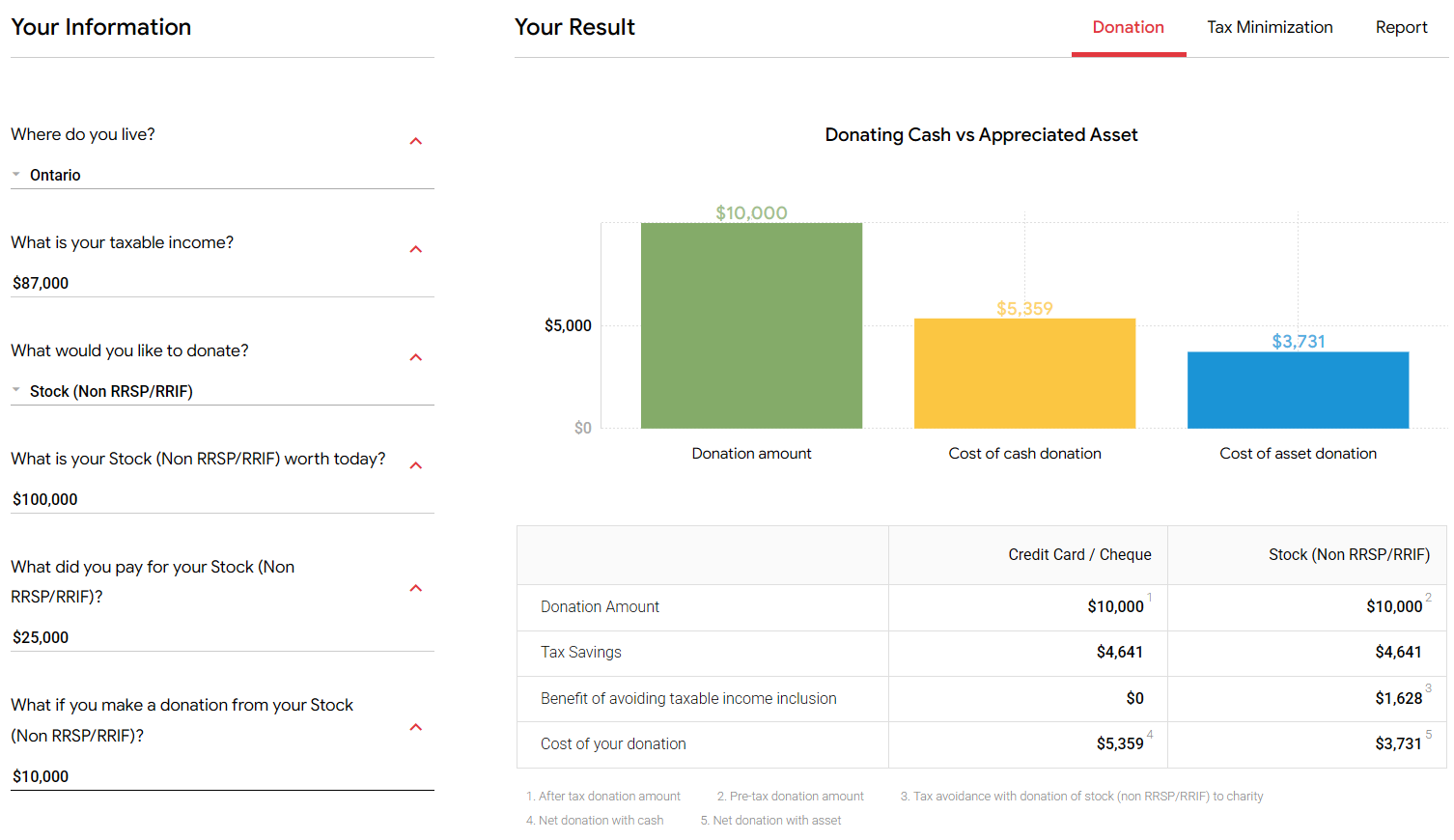

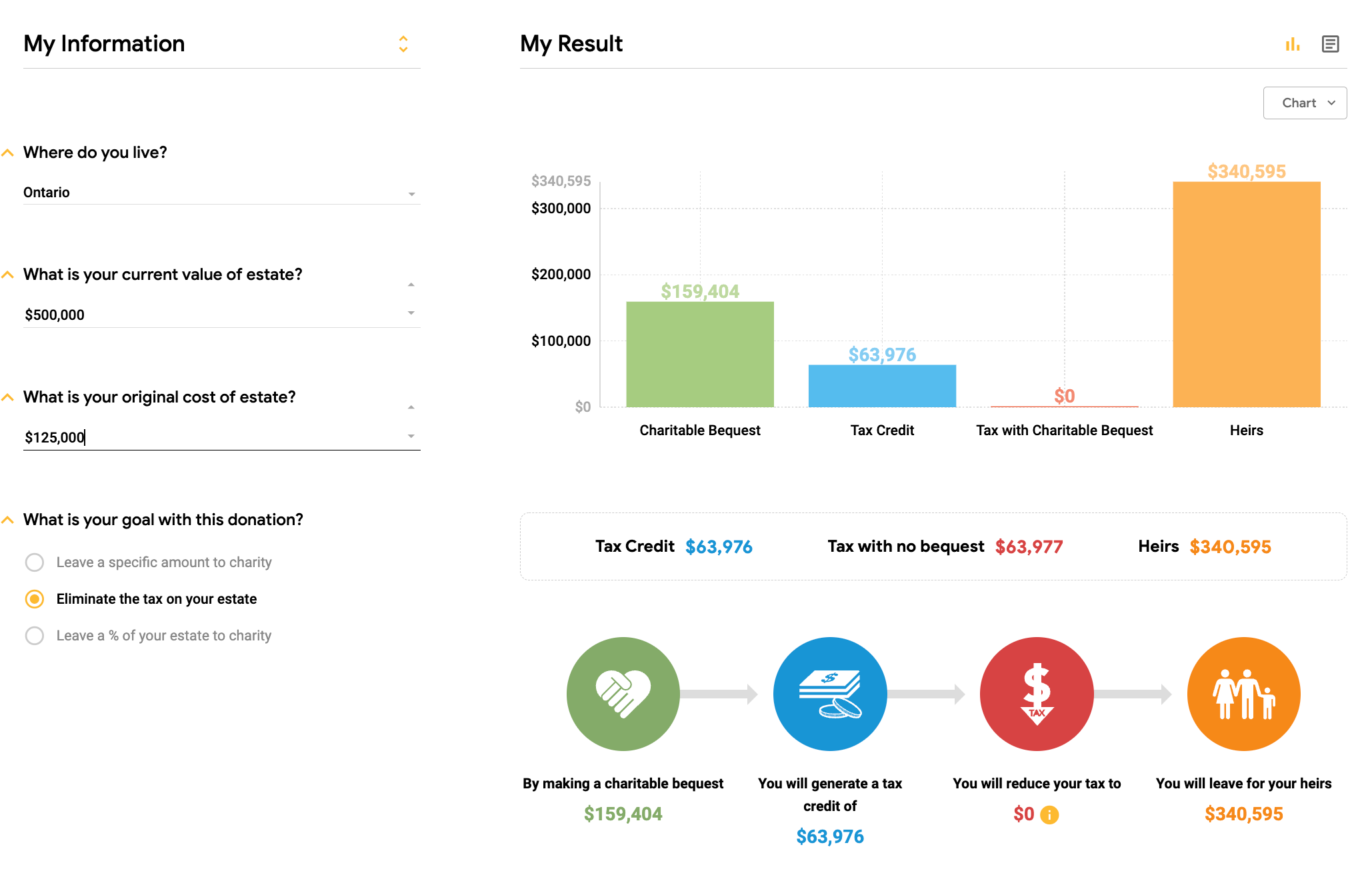

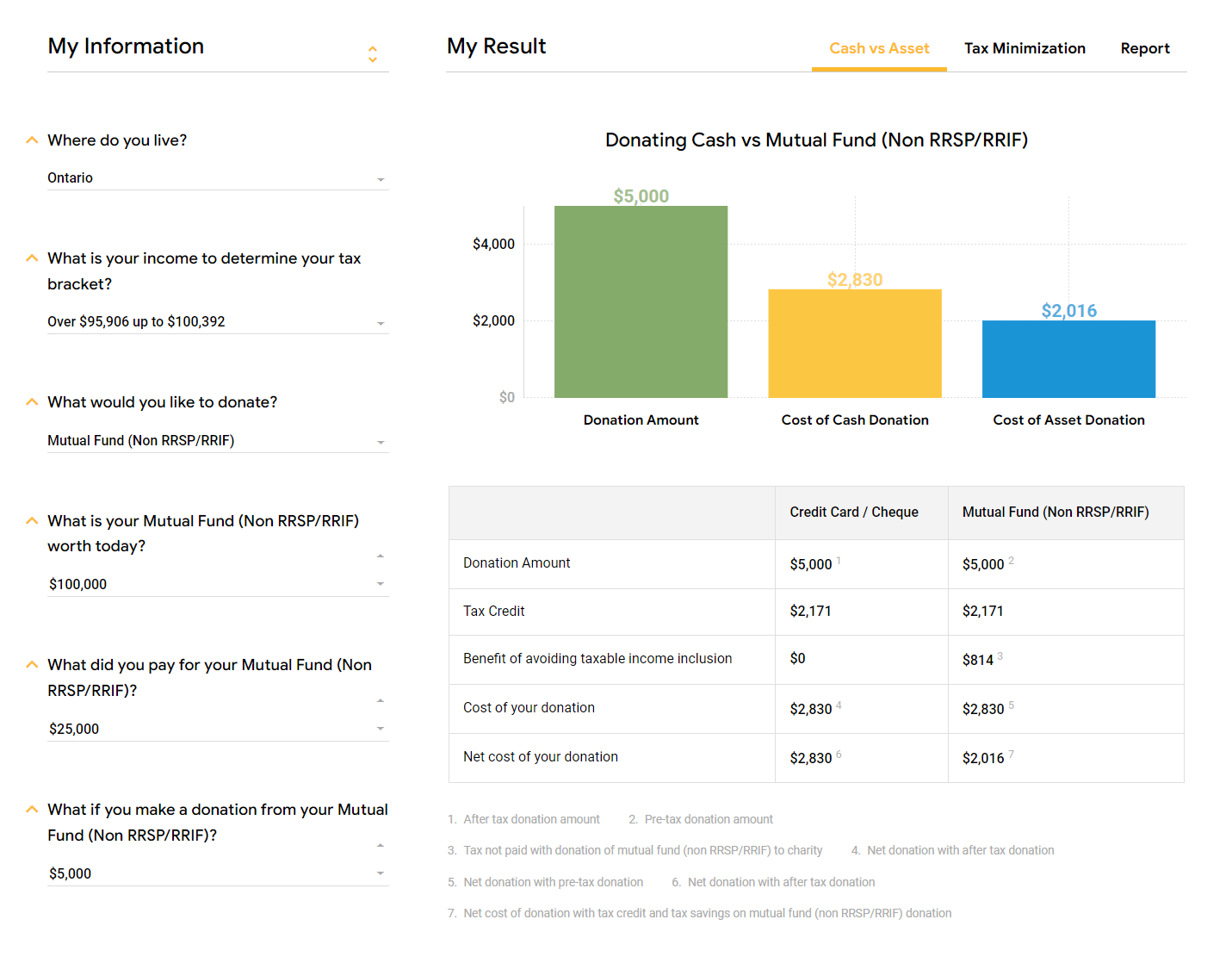

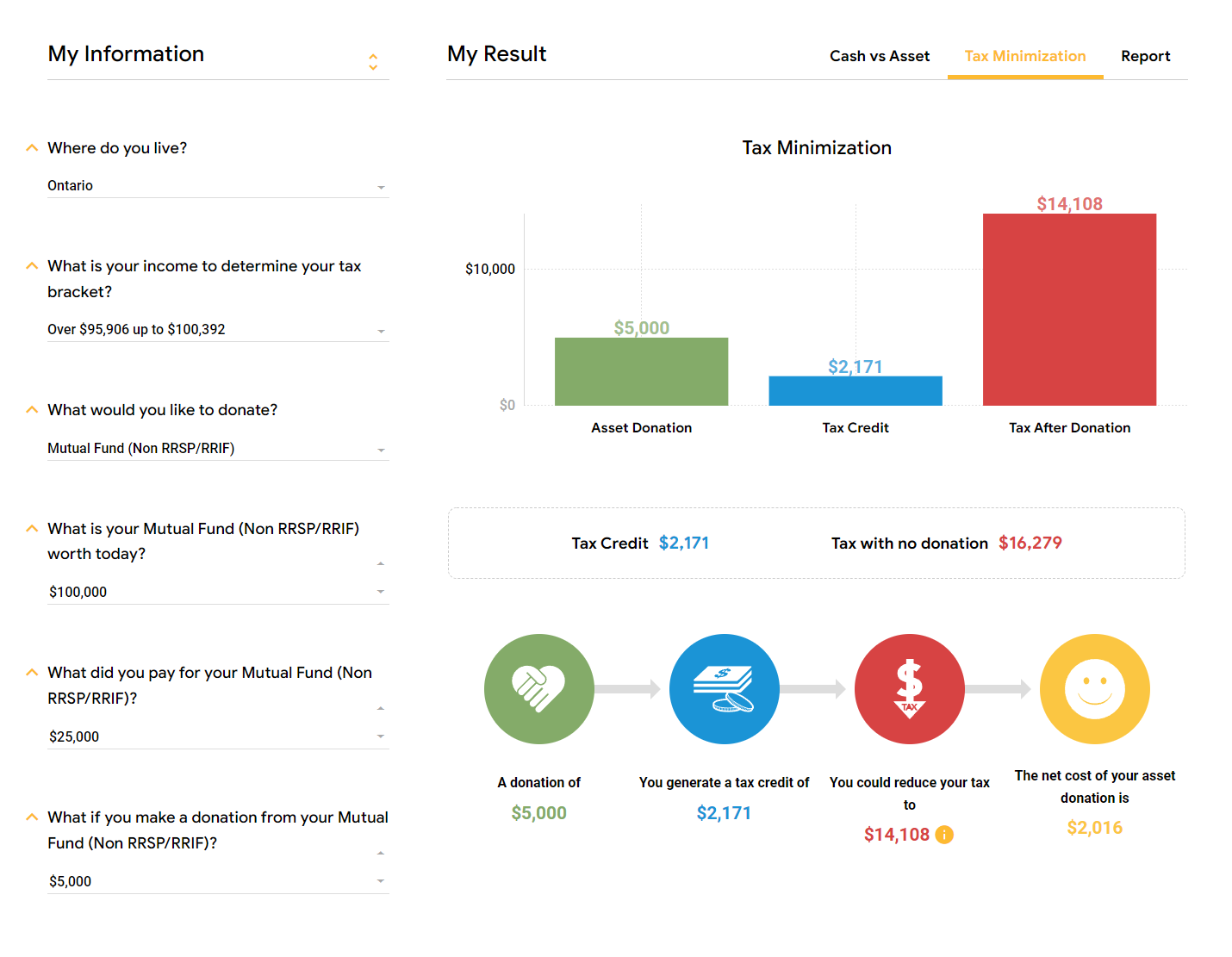

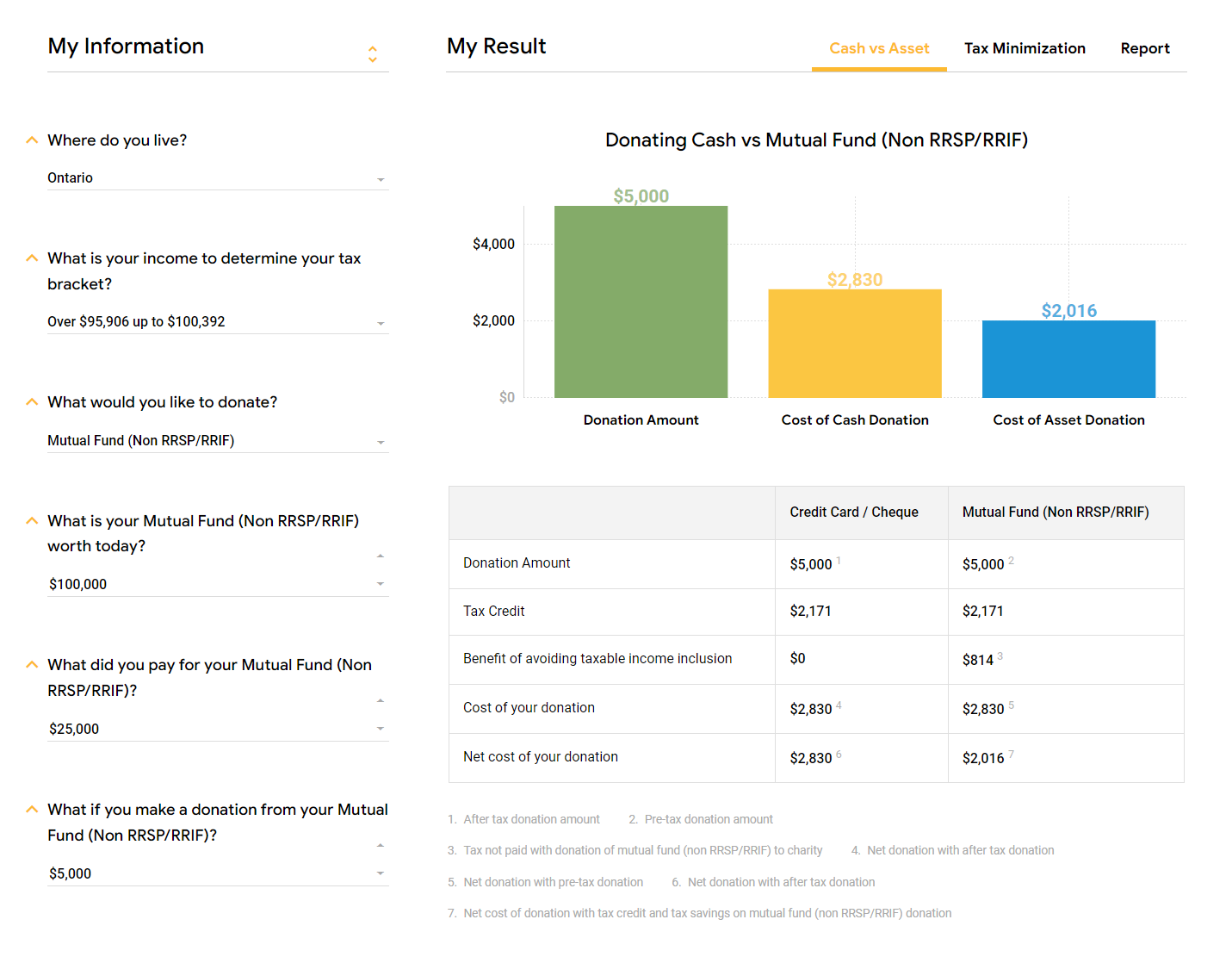

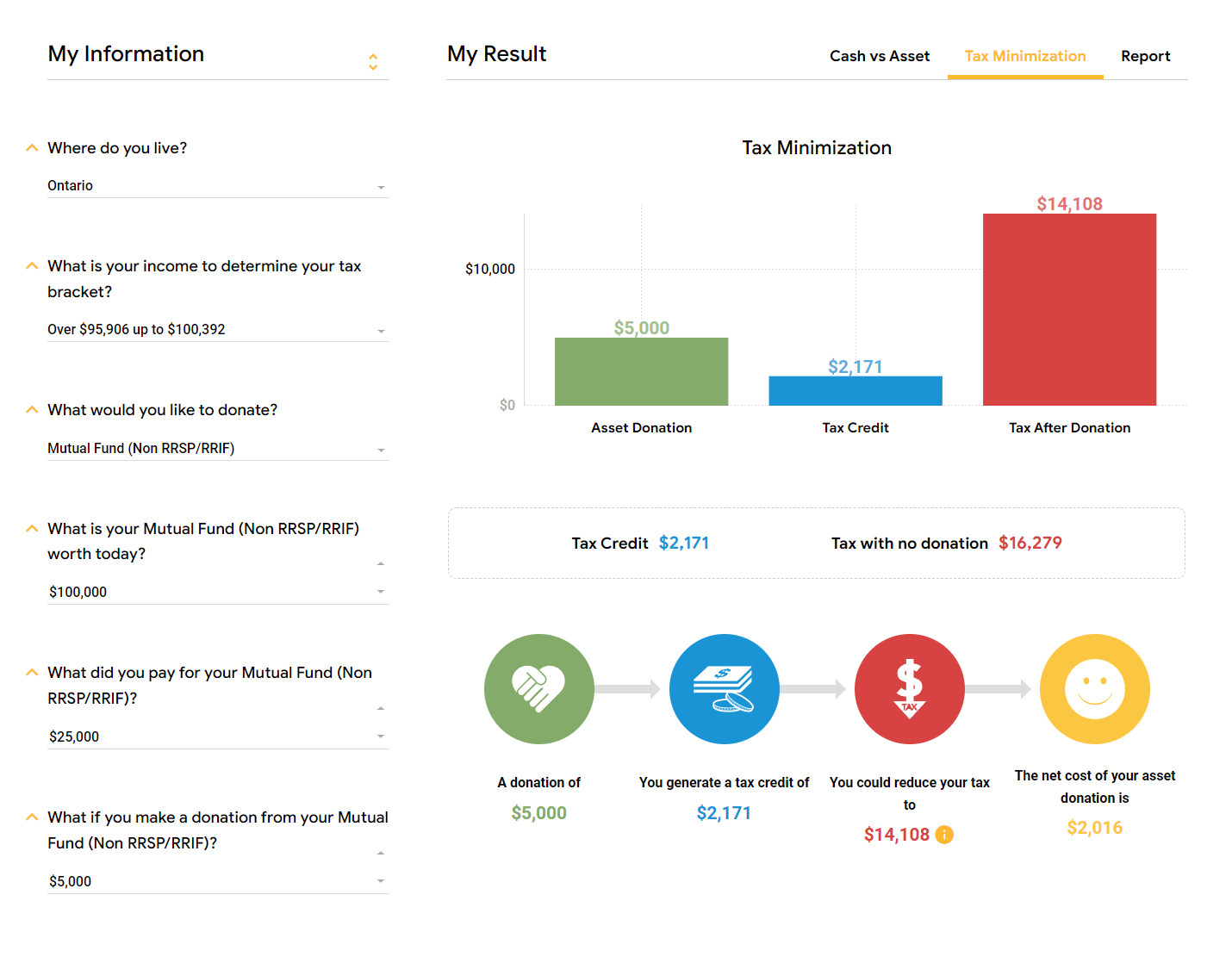

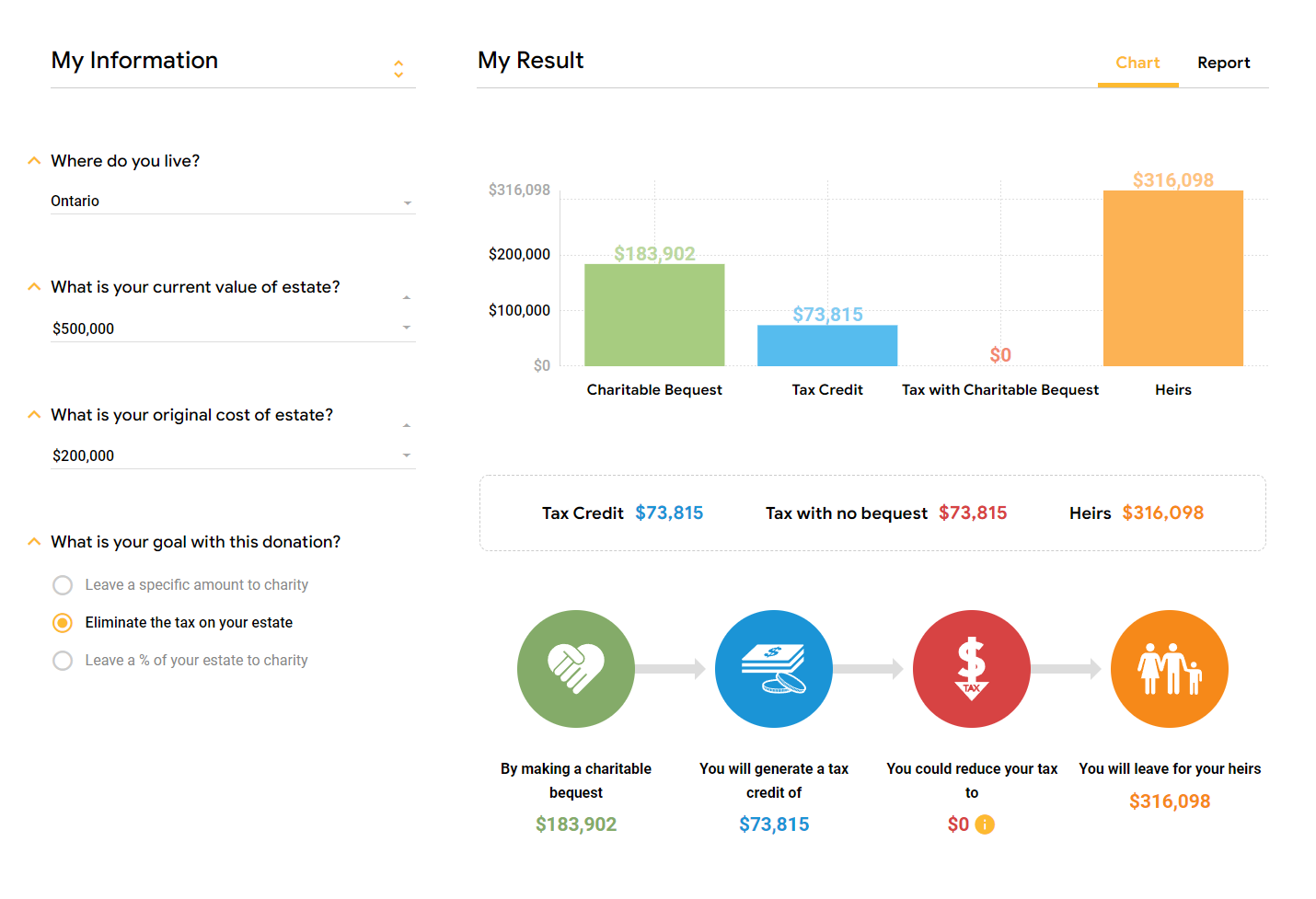

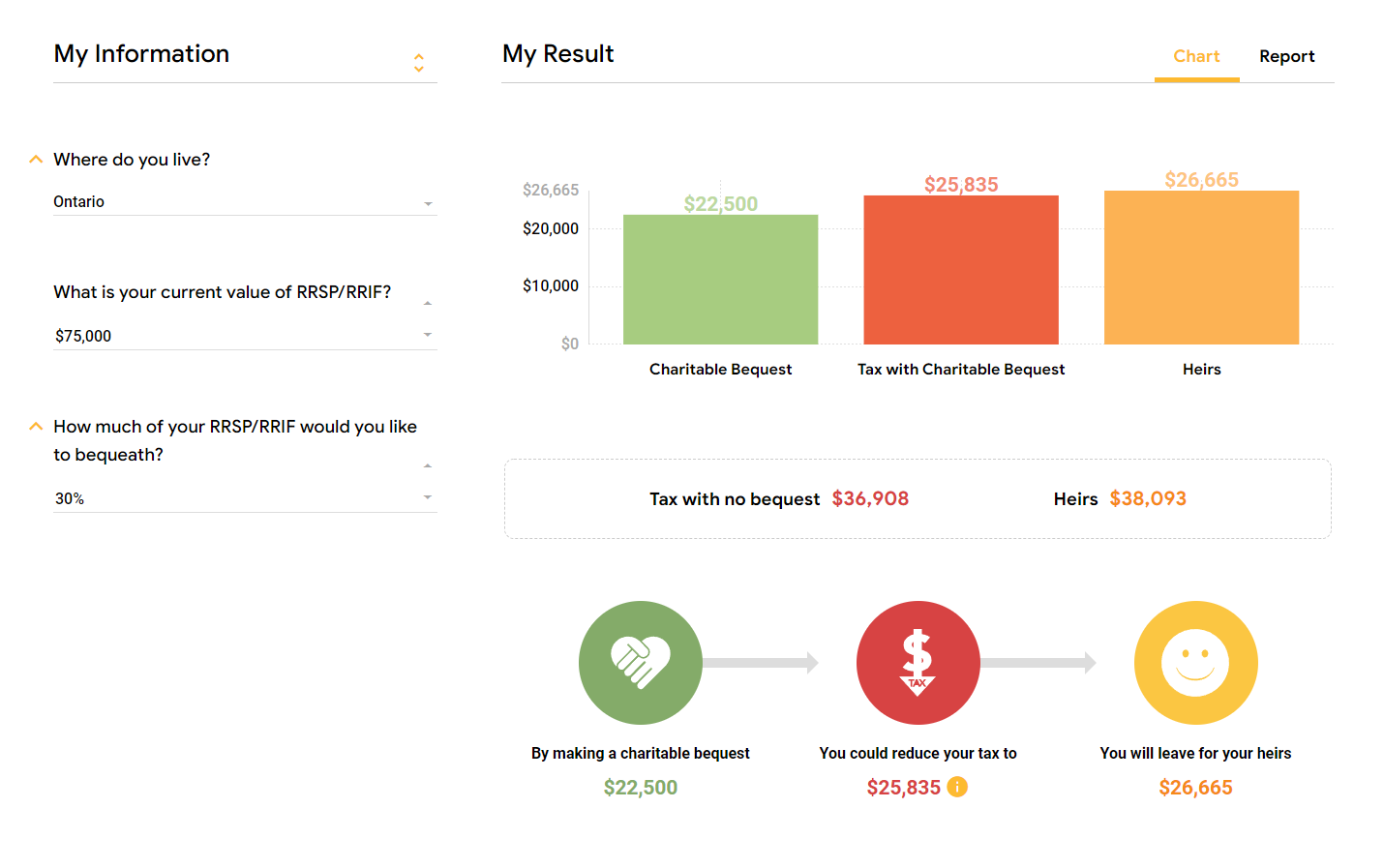

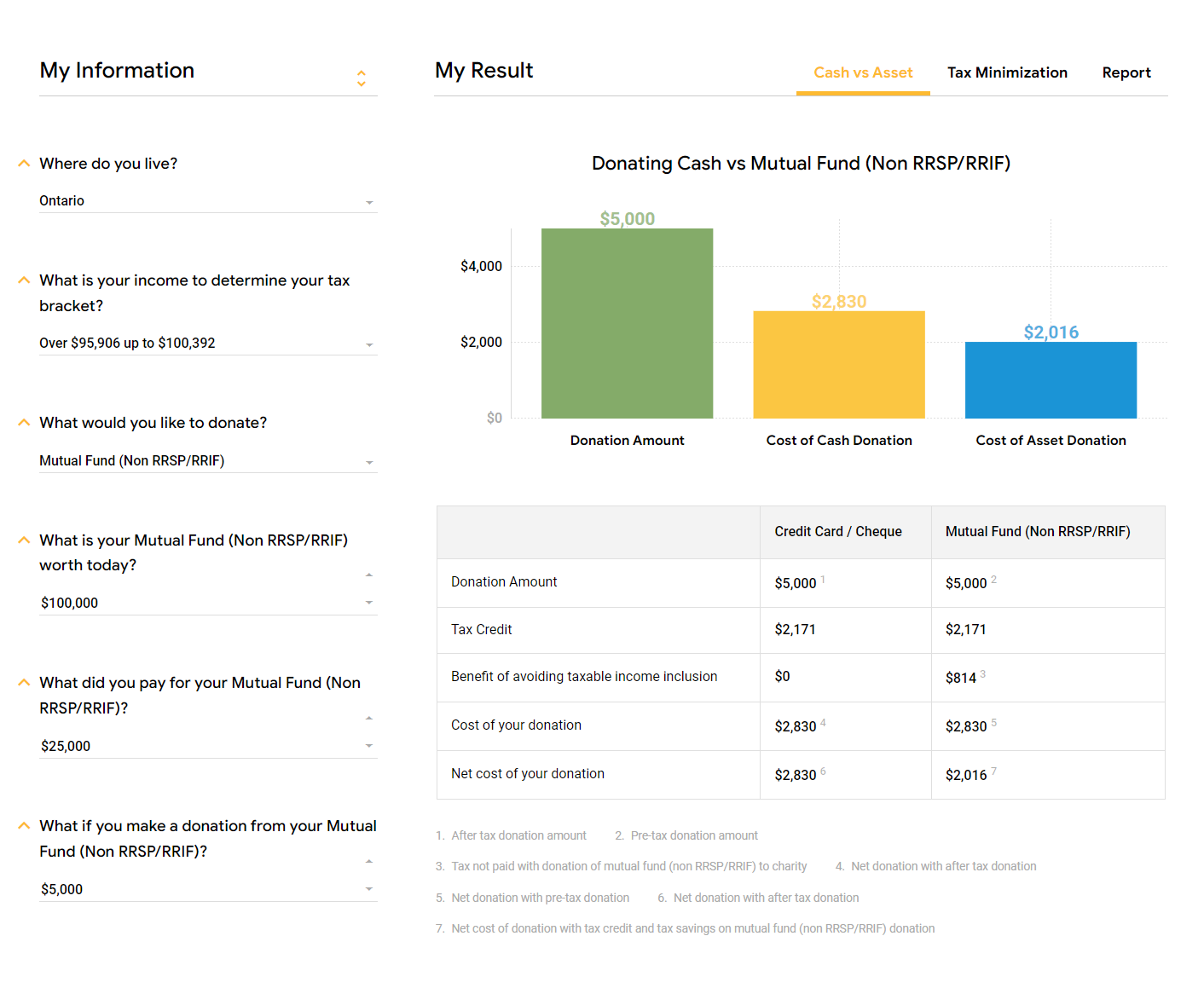

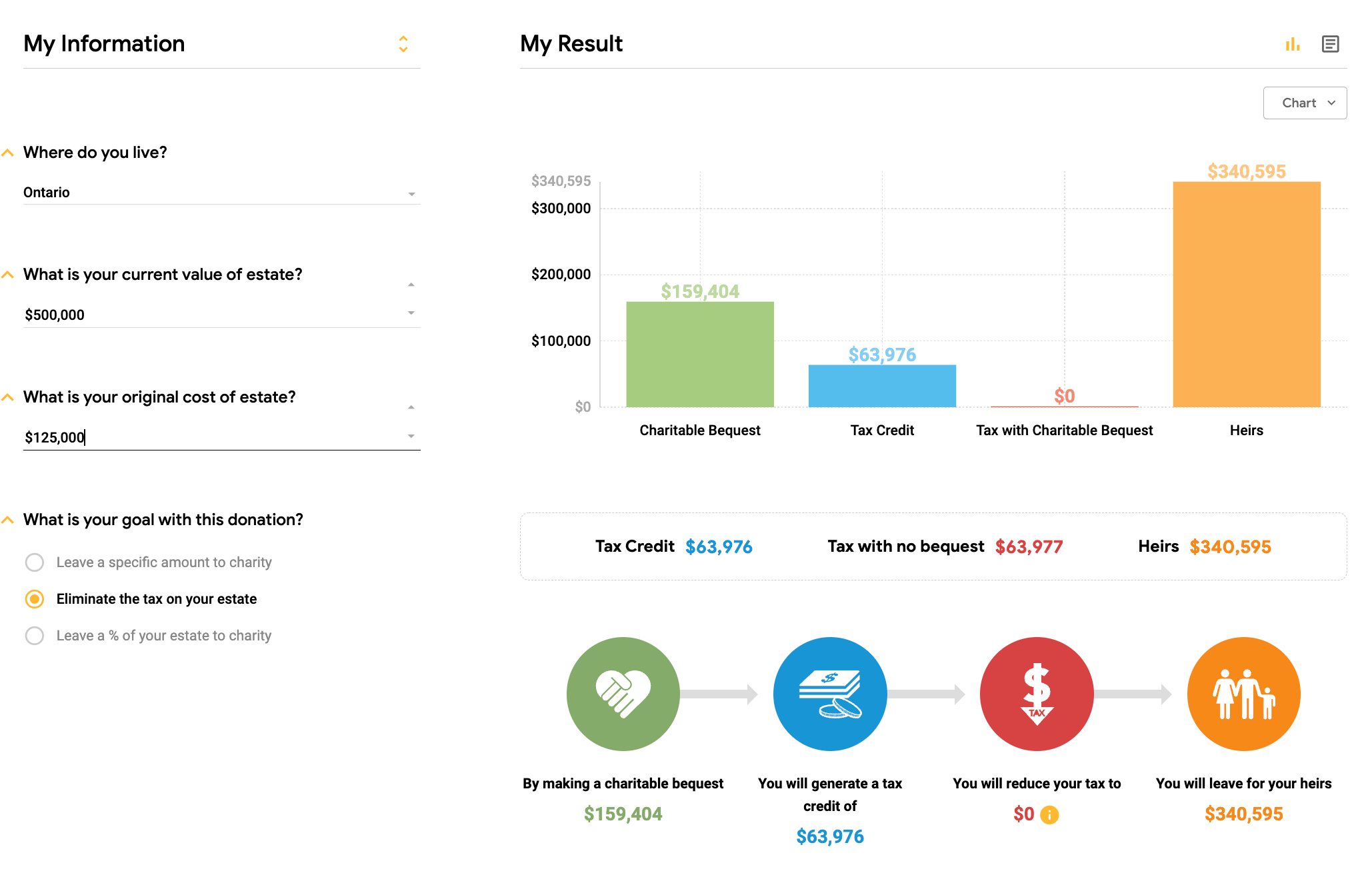

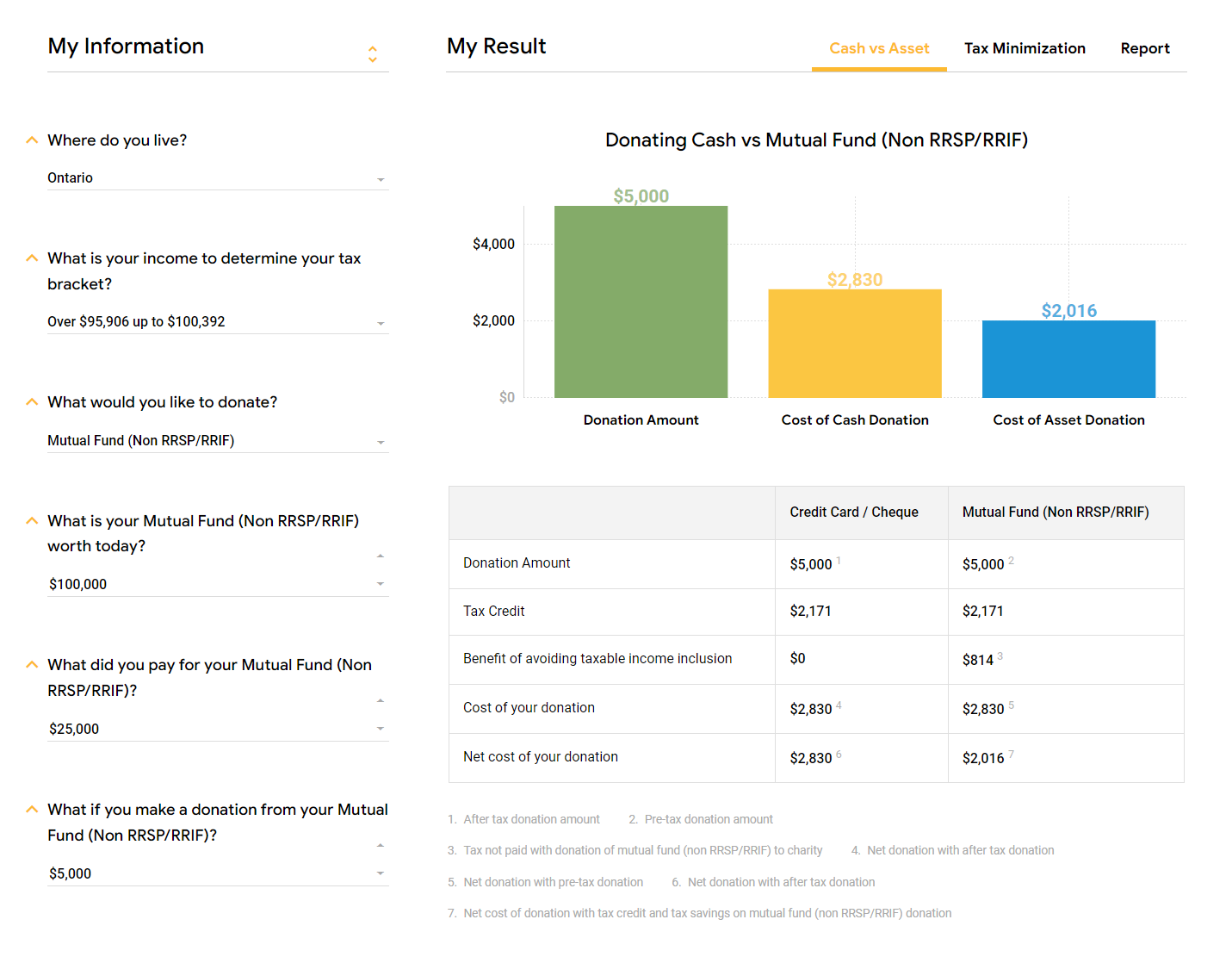

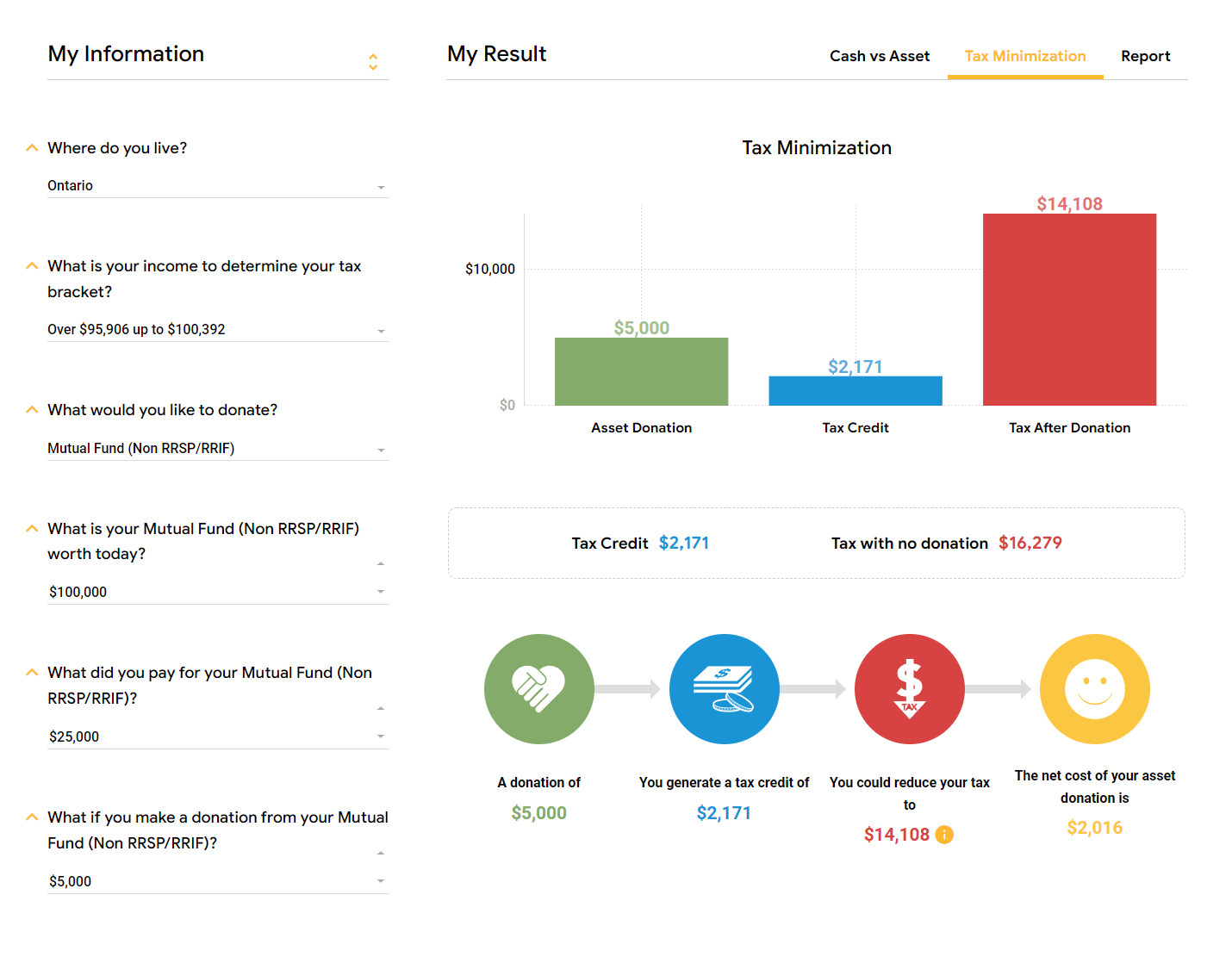

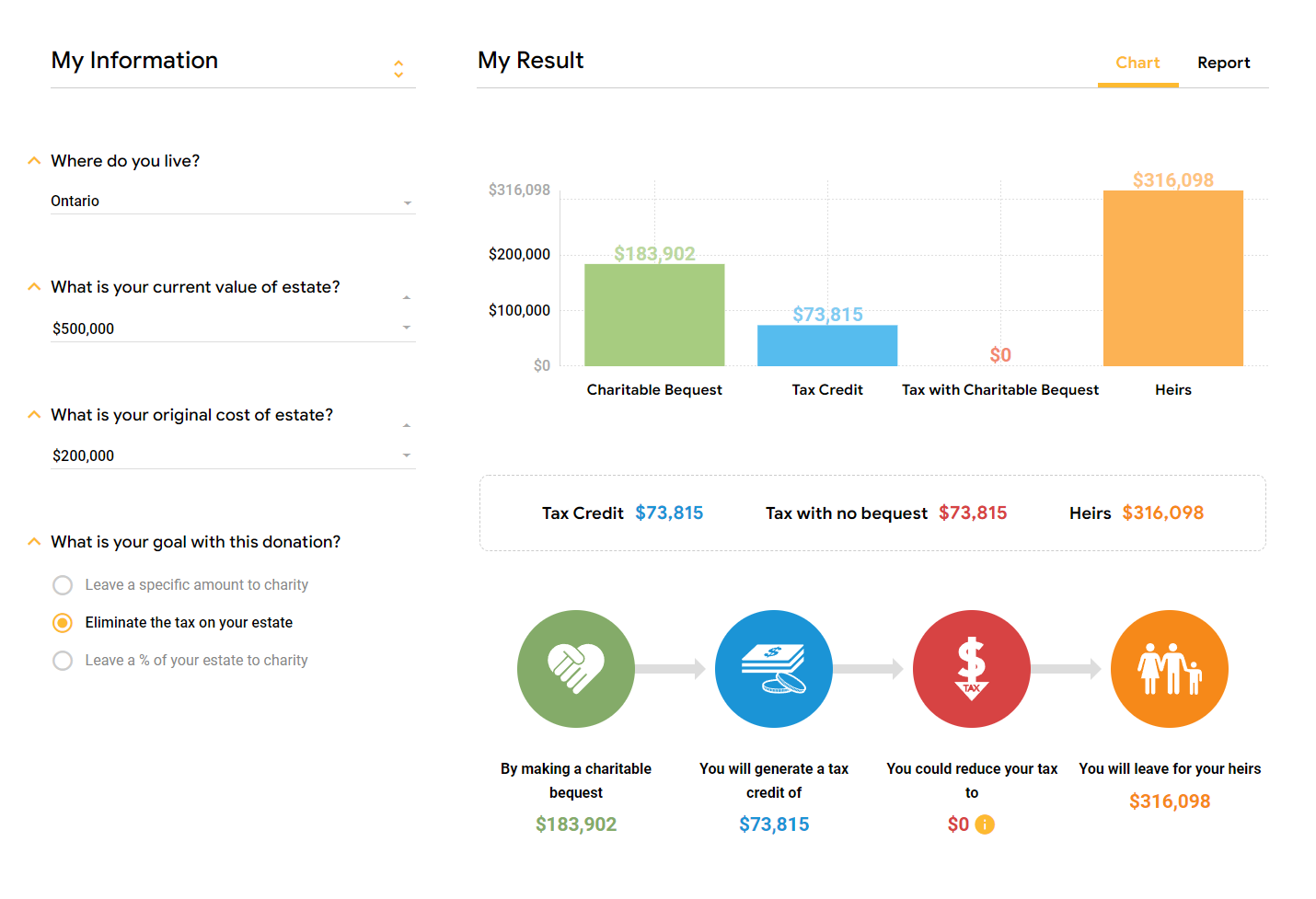

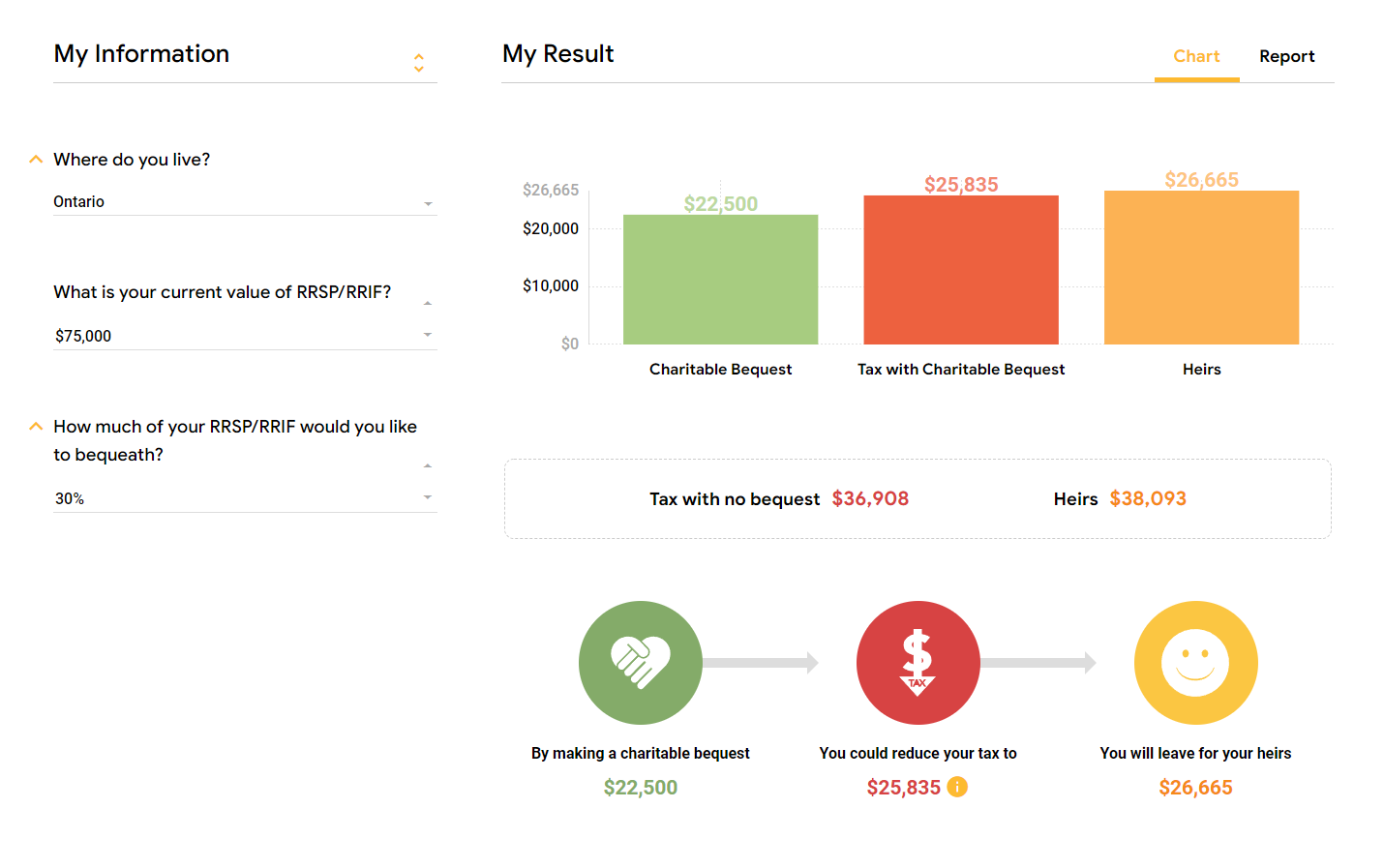

In addition to supporting worthy causes, charitable giving can also result in significant tax advantages. For donations made this year, donors may be eligible for a charitable income tax credit against their 2022 income. If you have a significantly increased income, perhaps from the sale of a business, it may make sense to make outsized charitable donations and use one of the charitable structures illustrated by the online app Giftabulator®. (see Giftabulator example more below).

To realize an income tax deduction for 2022, gifts of cash or assets must be made on or before December 31, 2021. Donations sent by mail must be postmarked no later than December 31. Gifts of securities, mutual funds, or illiquid assets require a longer lead time. –Reach out to your advisor well in advance to ensure funds can be transferred and trades settled before the year ends. Finally, to receive a charitable tax credit, you must itemize your deductions on your 2022 income tax return.

Selecting the right assets can yield further tax benefits

Donating cash is simple and fast, but savvy philanthropists take the time to evaluate which assets to donate and to understand the tax benefits of contributing assets other than cash. One generous donor was surprised to discover she could donate shares of stock that had significantly increased in value, thereby claiming an income tax credit for the full fair-market value of the shares; she also avoided a tax payment on the unrealized gain. Although not all charities accept shares of stock, many do, and the added benefit of a charitable deduction plus avoidance of gain can make this a very appealing donation strategy. In fact, depending upon the organization, you may be able to donate a variety of appreciated assets, including stock or cryptocurrency, or even a piece of real estate or tangible property like art or a car.

For longer-term commitments, consider planning your philanthropic strategy

For many truly philanthropic individuals and families, there may come a time when it makes sense to consider a planned giving strategy. “Planned giving” generally refers to an organized, thoughtful strategy for making charitable gifts beyond writing the occasional cheque or responding to a solicitation from a friend. Planned giving can include naming a charitable organization in your will or other estate planning documents. If you also want to give money in a thoughtful way during your lifetime, it can include opening a donor-advised fund account or establishing a charitable vehicle such as a private foundation.

Private foundations require the services of a lawyer and an accountant, which generally makes sense only for large contributions. There are other considerations, too, such as the ongoing administration and oversight of the entity, board formation and management, and ongoing tax-filing obligations. With these associated costs,however, comes a great deal of flexibility as you invest and ultimately give away funds, and a private foundation can serve as a permanent entity to perpetuate your charitable legacy.

Setting up a donor-advised fund (DAF) account, by contrast, is easy. Unlike private foundations, DAFs require no startup costs or ongoing tax filings, and they may be suitable for more modest initial contributions. Your investment choices are more limited than in a private foundation, but they can include a broad range of strategies, as well as customized portfolios. You may recommend grants from time to time, as frequently and to as many organizations as you wish, although the DAF provider has the ultimate authority to decide whether to make a grant. This reduced control is offset by the higher potential tax-deduction limit available for contributions to a DAF and by the ease of its administration.

Your accountant, attorney, and financial advisor can help you decide whether a planned-giving strategy is appropriate and if so, which vehicle makes the most sense for you.

Your advisor can help maximize your giving

Your financial advisor can help you advance your philanthropic strategy with information, resources, and experience. Working with you and your family, your advisor can help match your giving goals with charitable-giving best practices, taking into account these and other issues:

- How can I maximize my charitable impact this year?

- How does my charitable giving fit in with my overall financial plan?

- Am I incorporating the tax benefits of charitable giving into my strategy?

- What is the impact of inflation?

- Are planned-giving vehicles right for me?

With so many options for giving, engaging your trusted advisor is an important first step to achieving your charitable goals and realizing your philanthropic vision.

Click here to set up a 20 min demo