Giftabulator® and similar tools can increase the number of bequests for charities in several ways:

- Educate donors: These tools provide interactive, secure online applications that educate donors about tax-efficient giving strategies, including bequests.

- Illustrate benefits: They demonstrate the tax benefits of charitable giving from appreciated assets and estates, making complex concepts easier to understand.

- Optimize donation processes: By integrating into a charity’s website, Giftabulator® guides donors through formulating gifts tailored to their unique financial situations.

- Facilitate estate planning: They help donors explore ways to reduce or eliminate tax implications while maximizing their charitable gifts, both for current and future estate planning.

- Convert annual donors: These tools can help turn annual donors into major and planned giving prospects more quickly by illustrating the potential of larger gifts.

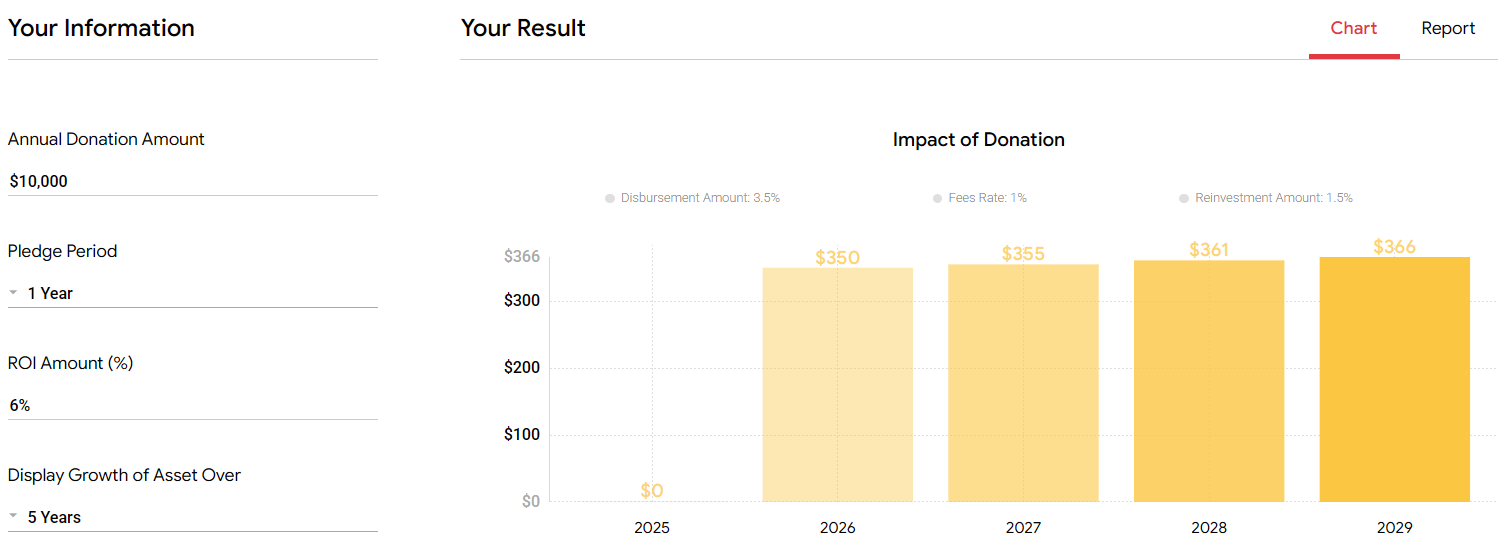

- Provide instant illustrations: They generate outcomes within seconds, showing the benefits of charitable donations based on various scenarios, income tax brackets, and types of appreciated assets.

- Support advisors: Financial advisors can use these tools to have more meaningful conversations with clients about charitable planning, potentially leading to more bequests.

- Increase donor engagement: By providing an interactive platform, these tools can increase traffic to a charity’s website and engage donors in the giving process.

- Demonstrate achievability: The tools show donors that making a significant gift or bequest is achievable, potentially encouraging more people to consider this option.

By leveraging these capabilities, charities can more effectively engage potential donors, illustrate the impact of bequests, and ultimately secure more planned gifts for their organizations.