Why Planned Giving is a good place to start for Major Gifts

Through Covid-19 we’ve all been made aware that the number of deaths is increasing, but guess what? Planned giving is not.

Remember, charities play two primary roles; one, provide services, programs, care that fill a large gap that governments can’t or won’t support in communities; and two, raise funds for these programs and services.

The provision of support for the needy, investments in science, and cultural education have made a tremendous difference for many during the pandemic. Overall, charities perform very well in providing these programs and services with limited resources, day-to-day and year-to-year.

The second area that charities focus is much more difficult, fundraising. The ability of fundraisers to engage in meaningful discussions with their donors is often a challenge. Possessing the ability to educate, illustrate and activate meaningful charitable discussion that shows the donor why their funding is important and illustrating how they can afford a tax efficient donation from taxable appreciated assets, this isn’t magic.

I was recently speaking with a colleague who advises philanthropists. She stated that in many instances, if the donor stopped their giving to the charity, they would be forced to end the program. In our discussion, the solution for the charity and the donor should be to develop a plan to sustain the program with an endowment with the donor from their estate, current assets or both.

Planned giving is an effective fundraising method, but it has its challenges. In future blogs, I’ll peel back the onion on charitable giving and give you an inside look as to why it’s such a good place to start when thinking about major gifts.

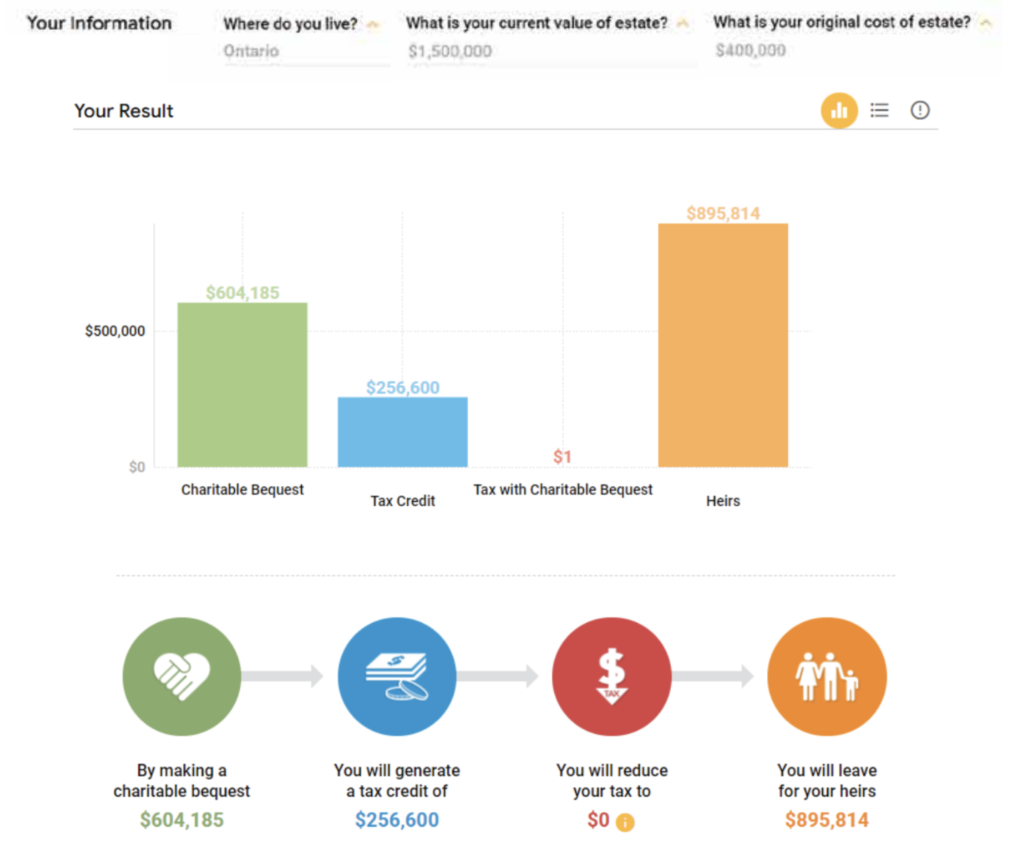

Giftabulator provides new tools for those in the charitable sector; helping them to explore and understand major gifts, planned giving and endowments with an easy to use client interface.

For more information visit Giftabulator.com