Think about this: only 4 percent of current wills contain bequests. Charities, as well as law, accounting, and financial firms that engage in estate planning with their clients, can play an important role in teaching the benefits of bequests. And although November, known as Make a Will Month, is fast approaching, there are still plenty of opportunities for you or your clients to start planning their legacy.

Why including a charitable bequest in your will is a good start to creating your legacy (CNW Group/Funding Matters Inc.)

For charities, estate planning can be one of the best strategies for encouraging philanthropy. Many individuals who are significant donors to charities have already written wills and established financial plans. This type of planning allows them to support their favourite causes during their lifetime. The next step is to show these donors the tax benefits of a bequest to charity.

Strategic philanthropy usually takes place between family members, financial advisors, and tax and legal planners. Just as important as a retirement plan, a philanthropic plan can be drafted in tandem with the development of an estate and financial plan to include charitable giving now and in the future.

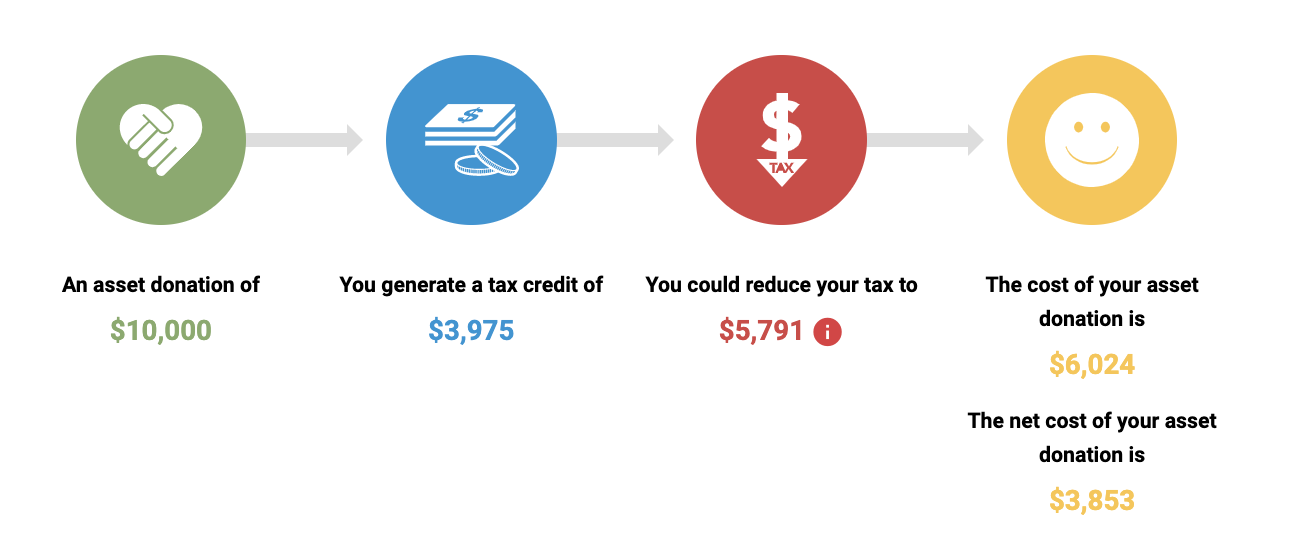

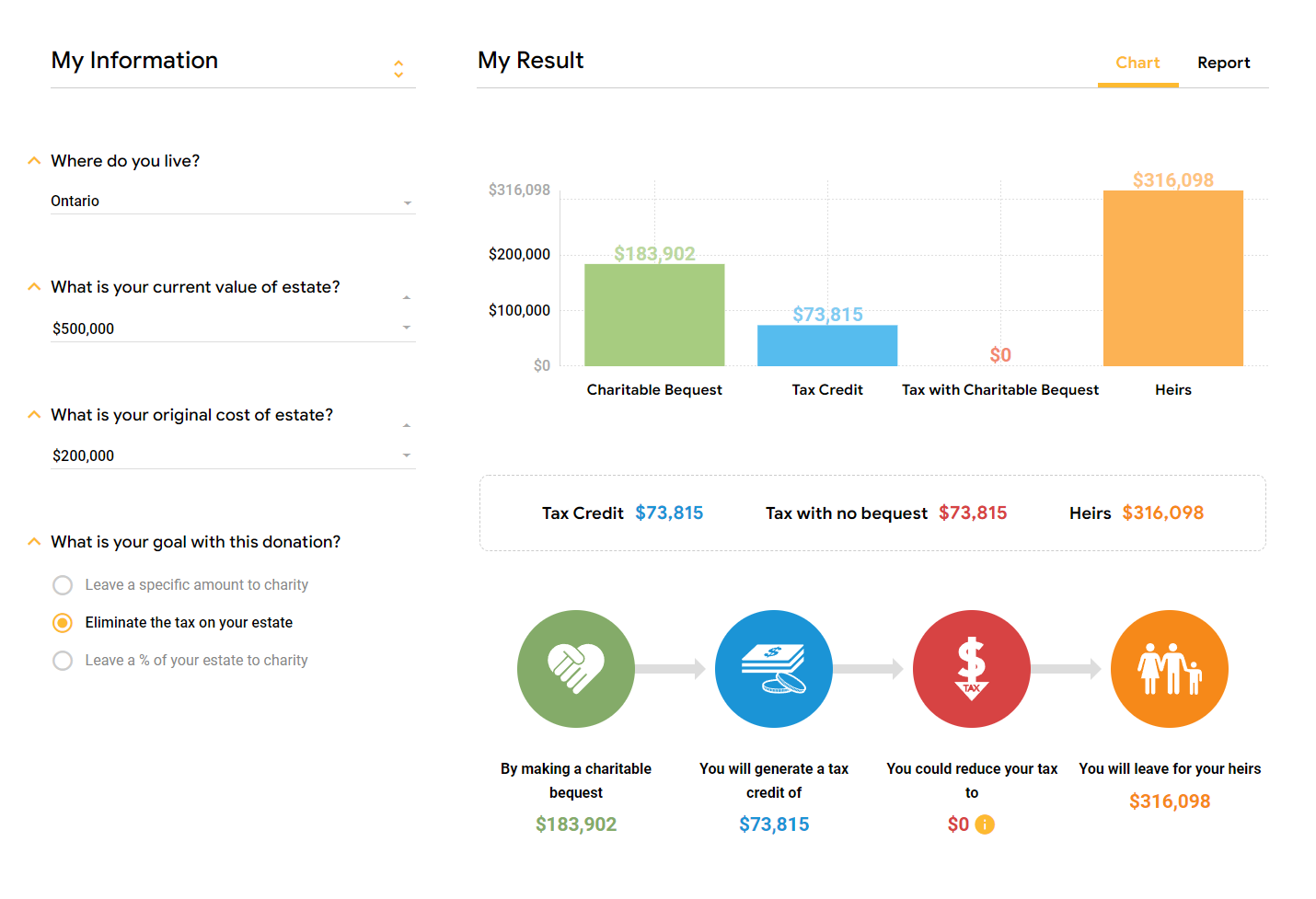

At FUNDING matters® Inc., we understand how important an effective major donation and legacy program is to the success of your organization. We designed an online tool called Giftabulator® – a virtual major-gift and planned-giving app that works hand-in-hand with you to make strategic charitable giving as straightforward as typing a few keystrokes. The Giftabulator® donor engagement process instantly illustrates the tax benefits of charitable giving from appreciated assets and estates, helping you make compelling gifting illustrations and proposals.

Many charities across Canada have seen the advantage of Giftabulator® acting like an extension of their own staff. You can also experience how creating smart philanthropic and tax-efficient solutions through estate planning will benefit your non-profit organizations and create satisfied client legacies for many generations.

Remember, charities play two primary roles: they provide programs and services to fill a large gap that governments can’t or won’t fill in communities; and they raise funds for these programs and services. The provision of support for people in need, for investments in science, and for cultural education have made a tremendous difference for many during the pandemic. Overall, charities perform very well in providing these programs and services with limited resources, day-to-day and year-to-year.

Bill Petruck, president of FUNDING matters® Inc., a consulting firm that advises charities on capital and endowment campaigns, and the developer of Giftabulator®, understands that planned giving can be intimidating. “Complex terms, complex calculations, and the risk of penalties if done incorrectly lead many fundraisers and financial advisors away from discussing planned giving strategies with their donors or clients, which in turn leads to expensive lost opportunities for all parties.”

Petruck knows many donors “could have given more in 2022 in order to save on taxes.” He developed Giftabulator® to make the concepts of major gift and planned giving easier to understand. “When charities and advisors can teach the core capabilities of strategic philanthropy, they provide value to their clients and that translates to value for everyone.”

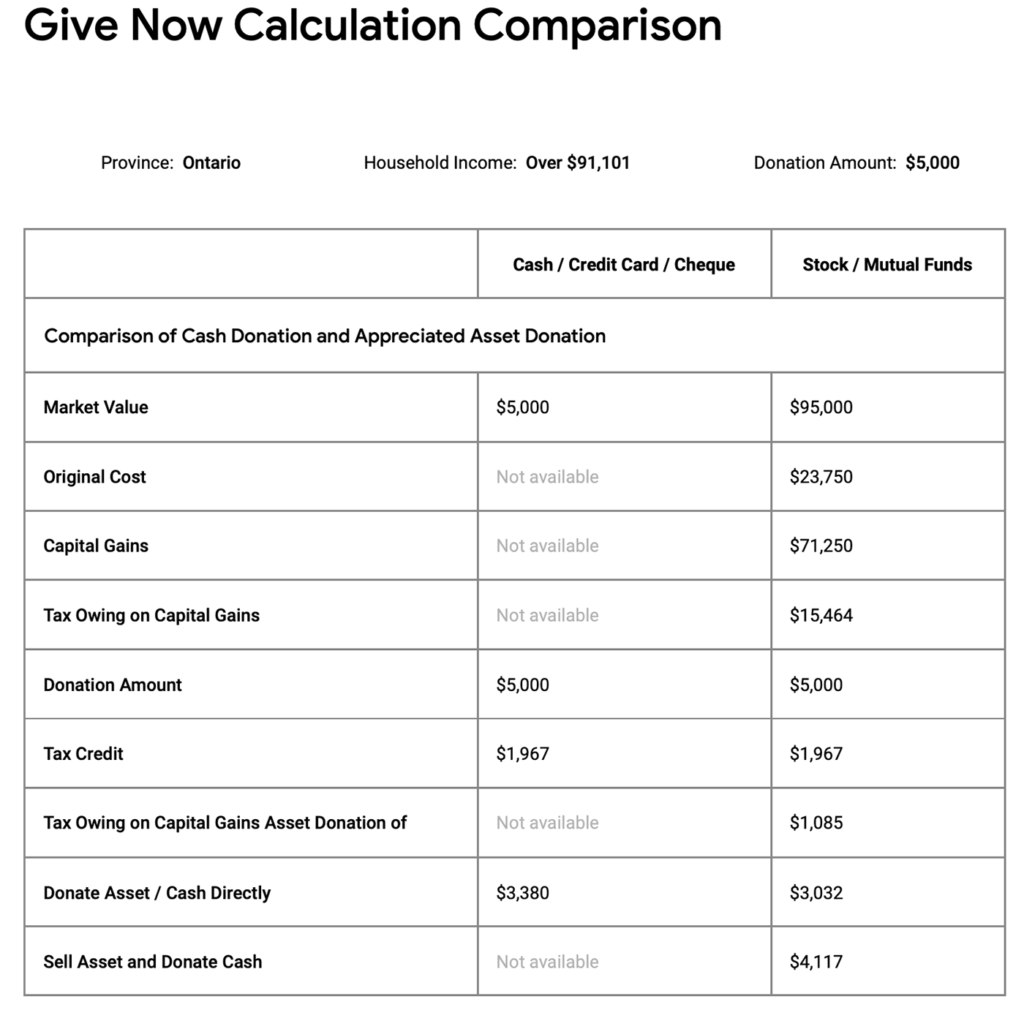

Petruck is concerned that 96 percent of current wills do not include a bequest. He emphasizes that charities need to educate donors about endowing from the donors’ estate and current assets. “Rather than relying on a widely and often randomly focused fundraising appeal at the end of the year, both donors and charities would benefit financially from targeted discussions about the importance of donating – and from a tool that shows donors how they can afford a tax-efficient donation from taxable appreciated assets.”

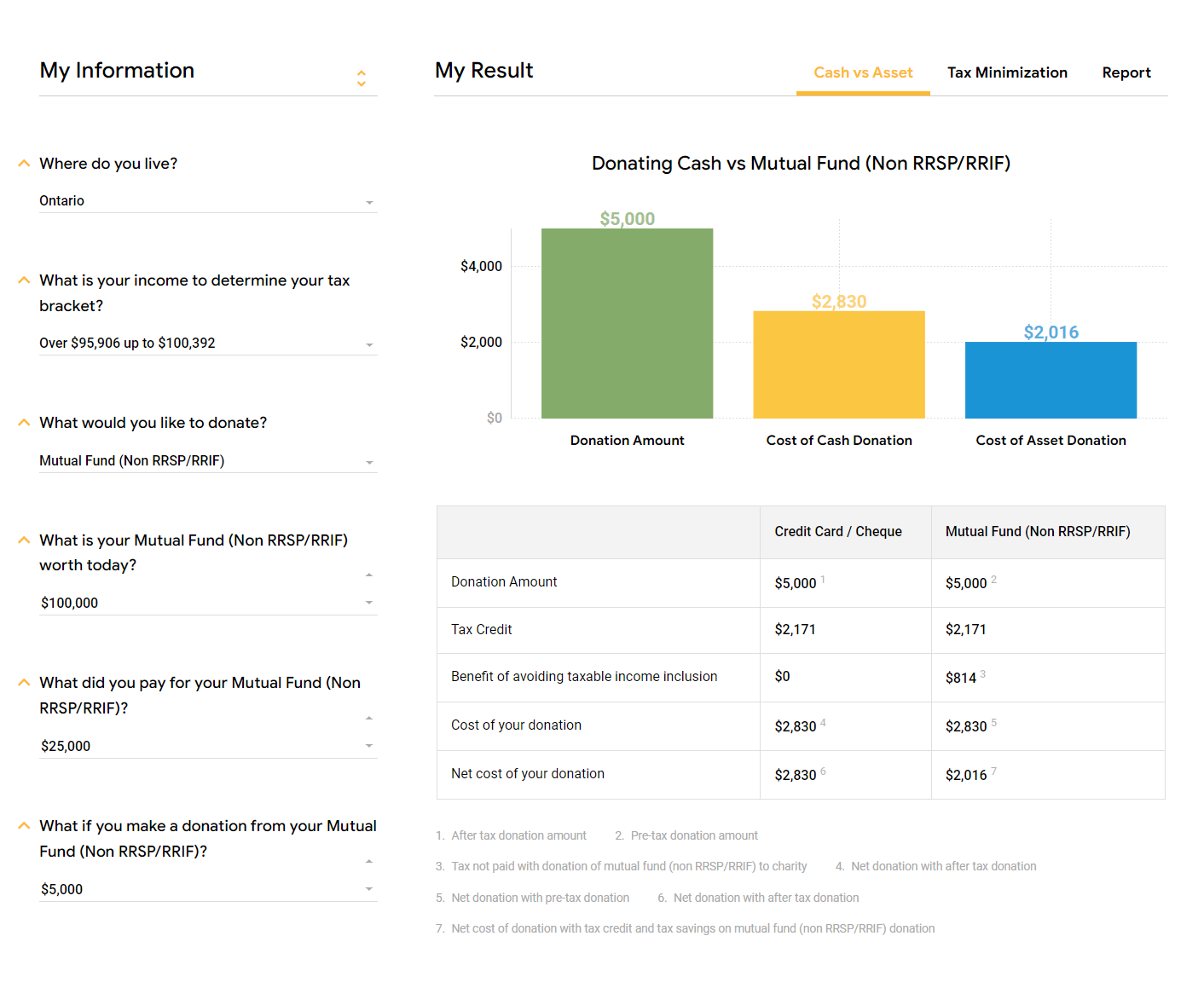

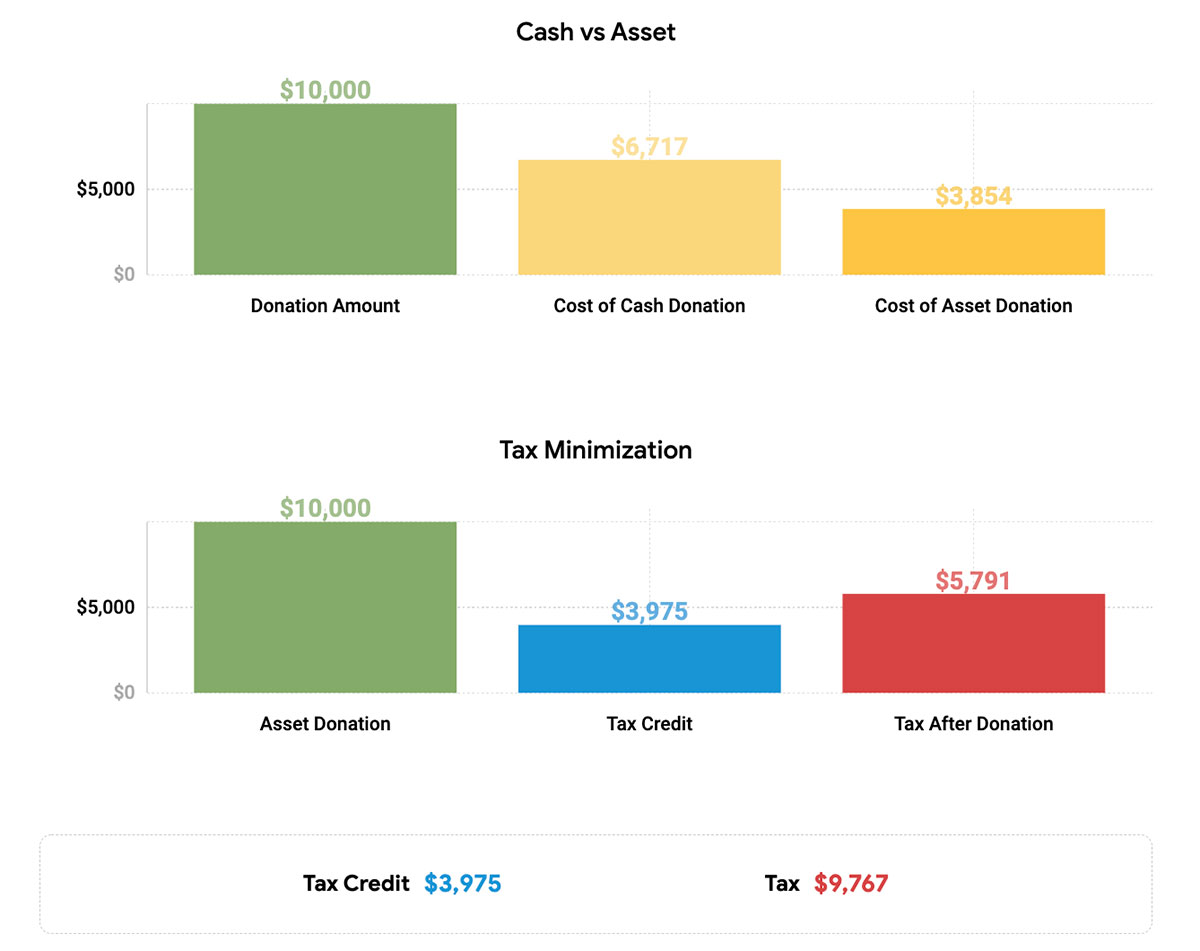

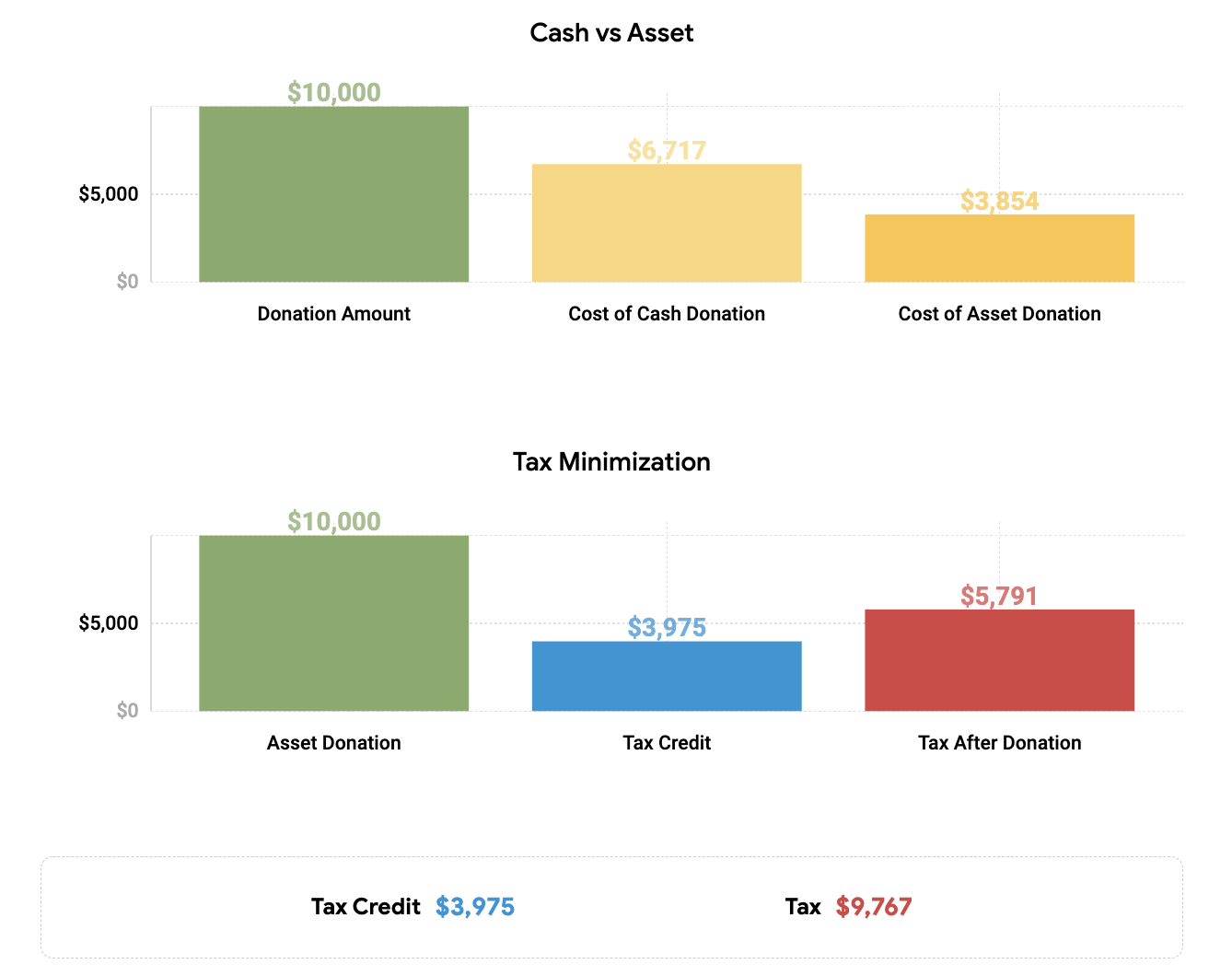

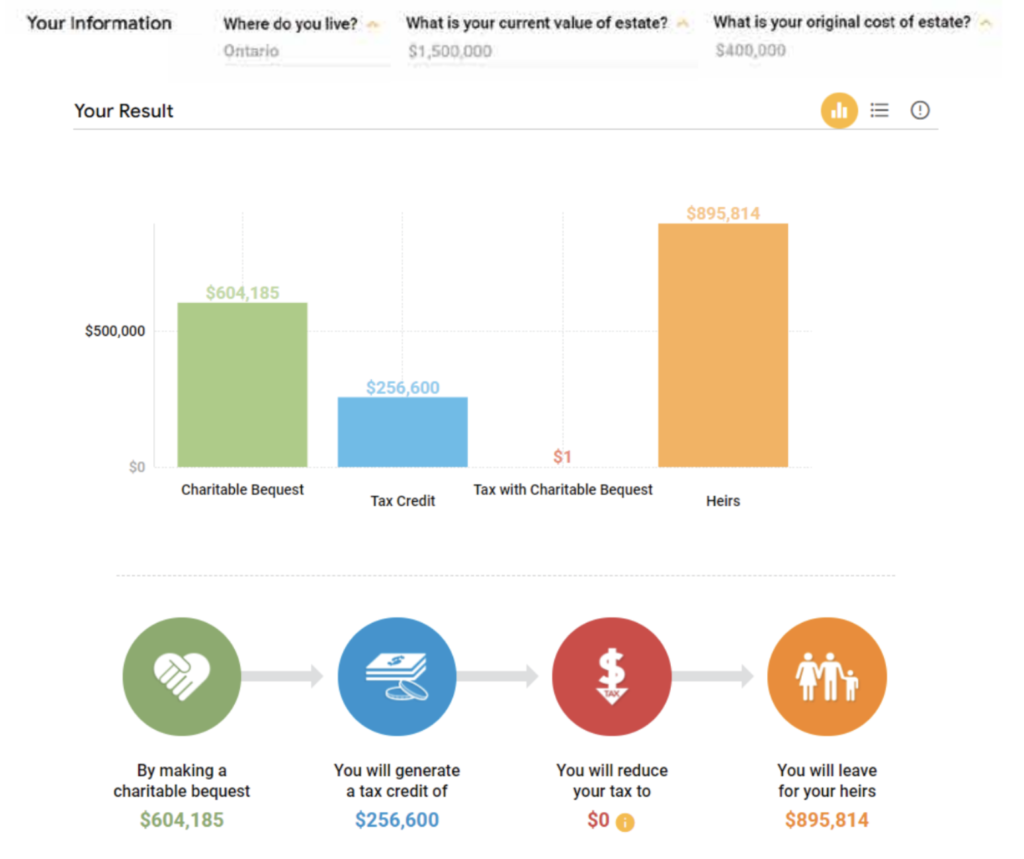

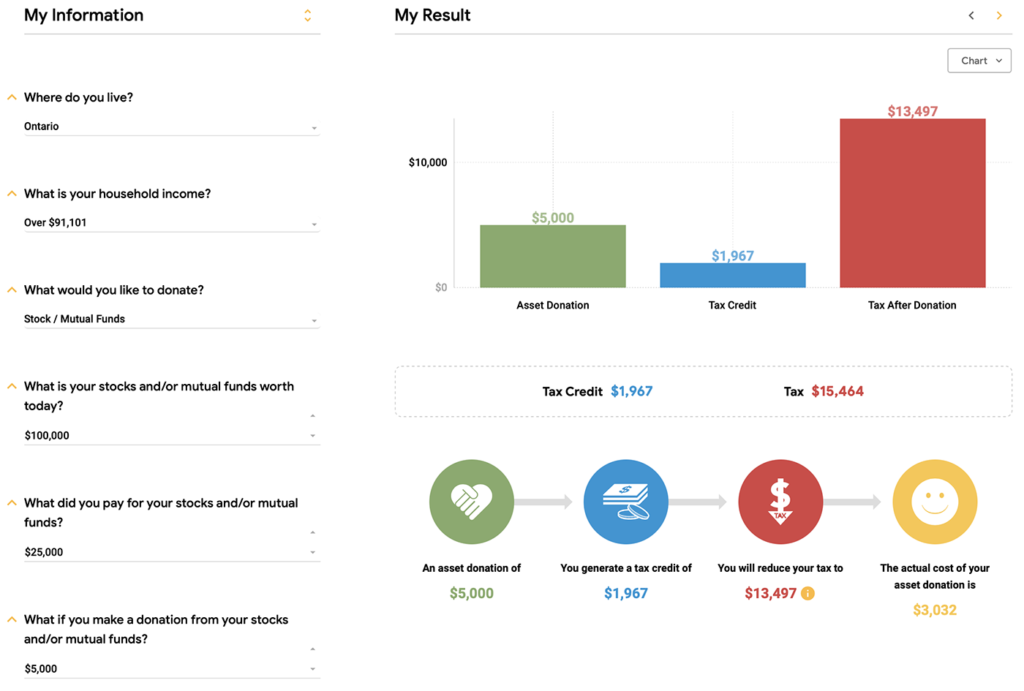

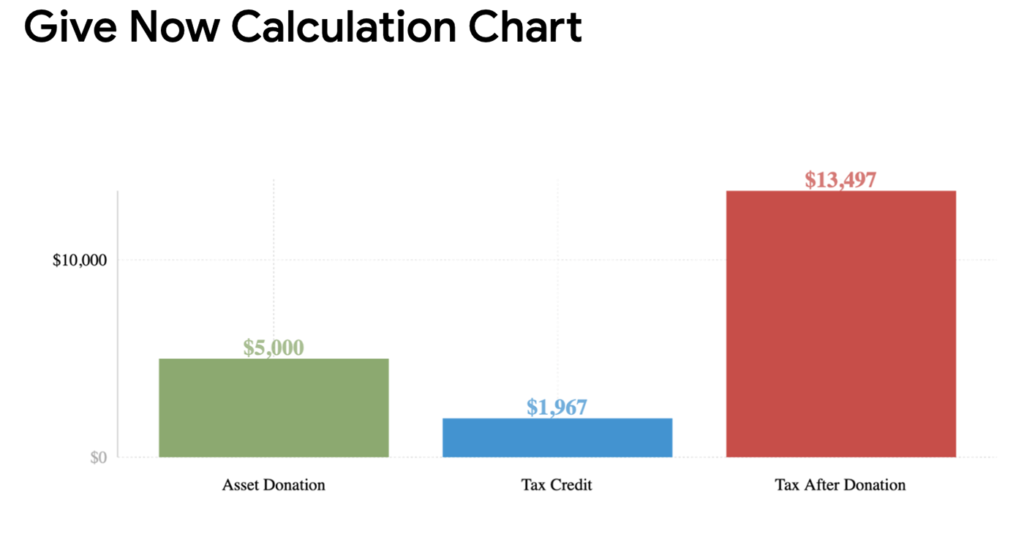

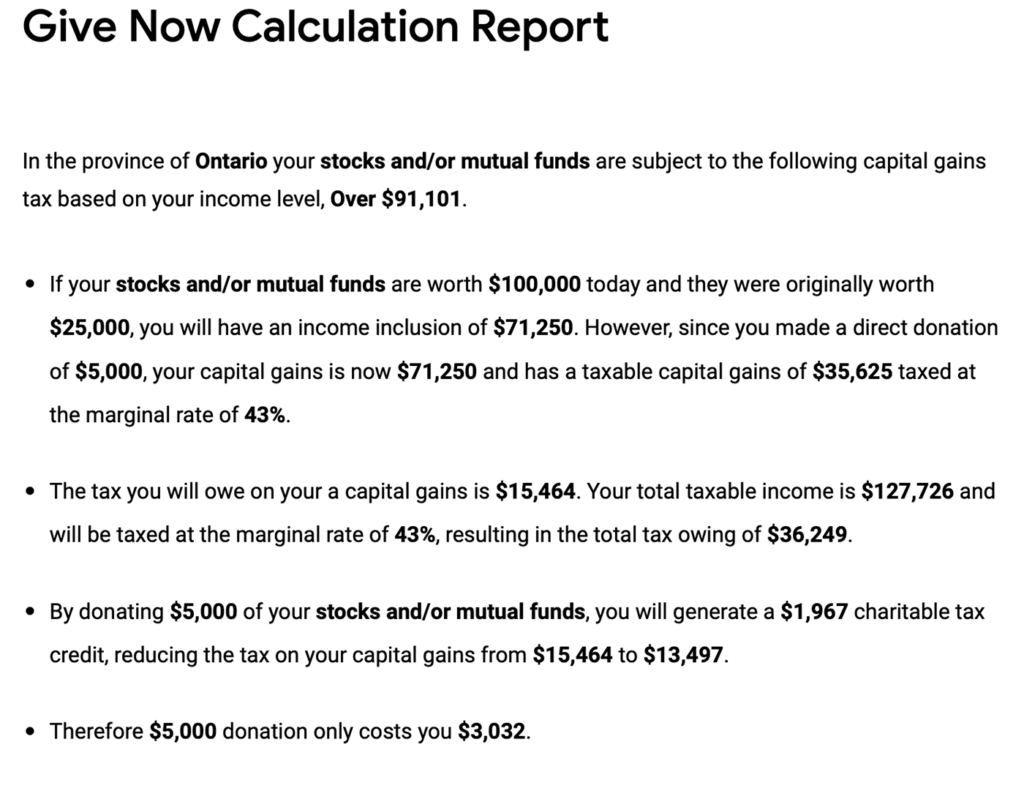

Giftabulator® is that tool, pre-programmed with charitable giving scenarios based on region, household income tax brackets, and tax payable on appreciated assets such as stocks, mutual funds, registered investments, secondary property, and private company shares. Giftabulator® generates outcomes within a split second to illustrate the benefits of a charitable donation.

Planned giving can revitalize a fundraising program. With the right tool and with informed, supported staff, charities can sustain their giving programs and improve the financial position of their donors.

About Giftabulator®

Giftabulator® provides a tool for fundraisers and advisers in the charitable sector, helping them to explore and understand major gifts, planned giving, and endowments with a user-friendly client interface.

Giftabulator® is a social venture founded by FUNDING matters® Inc., dedicated to innovation in major and planned giving, philanthropy, and estate planning. FUNDING matters® is based in Canada with offices in the United States and a team of engineers, lawyers, accountants, investment advisors, fundraising experts, and communicators who find joy in supporting non-profits doing amazing work.

To date, FUNDING matters® Inc. has generated over $620 million in new gifts for hundreds of non-profit organizations. The innovation and evolution of Giftabultor® by FUNDING matters® founder Bill Petruck on how technology and donor motivation are changing philanthropy has been featured in BNN Bloomberg, The Globe and Mail, and hundreds of other media outlets.