Over the years I have had the privilege of being interviewed by and presented with Patricia Lovett-Reid discussing the importance of estate and philanthropic planning to her audience and to many organizations, their supporters and members. It was a platform where we heard many interesting and challenging questions regarding estate and incorporating charitable giving. These sessions provided many answers to a myriad of issues, concerns around the importance of financial planning, how lawyers, accountants, and financial advisors needs to be engaged with their clients.

This past week, Patricia commented on LinkedIn a topic that we had not discussed in any of our encounters, that being, winning the lottery! What a great topic for new found wealth, that these lucky winners find themselves in and this especially relates to another lottery style windfall, inheritance. Just as if, your six or seven numbers were to come up, sometimes the same is true for an inheritance.

How much might one want to give to charity from the windfall? There are several options in looking at how one might become a philanthropist and have fun doing it. The $70M LottoMax is tax free but with the right investment strategy, however the growth after the first year is taxable. With your advisors, look at how much you can give away from your taxable capital gain to not only benefit a charity but yourself too.

The role that professional advisors play in helping these newly minted millionaires is invaluable. Let me show you a way we illustrate the tax calculation on a $70M lottery windfall. Assume that your $70M is invested and generates 6% ROI. The growth in year one will be a taxable capital gain of $4.2M. The tax on that $4.2M would be approximately $722,655. Now with a donation of $1.5M almost all of the tax is eliminated.

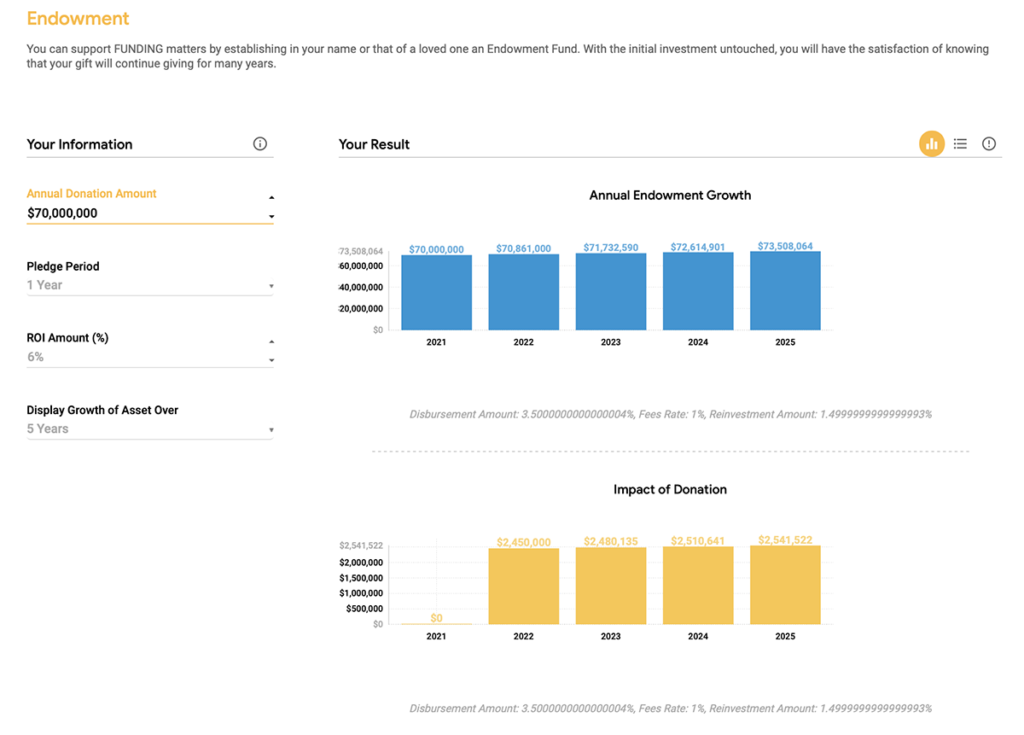

Now, assume your $70M windfall is invested at 6% you can have an impact of $2.45M in the second year. Every year afterwards your $70M will continue to grow even after you disburse 3.5% of your principal amount of $70M.

The illustration on GIFTABULATOR will not only show your $70M principal growth over time but will also illustrate the impact you can have with your philanthropy now and into the future.

We have developed GIFTABULATOR to calculate how much one can give to reduce their taxable capital gains. Don’t sell your taxable capital gain shares but work with your investment advisor and accountant and calculate how many shares your should gift to charity not to trigger the tax. This would be a real win-win-win for the donor, the charity and the advisor who helped make this a reality.