Will the financial advisor be the charity’s superhero and save the day? Or, will the charity take the lead showing their donors the best ways to give?

I can’t tell you how often I’ve heard in the past 20 years, “we’re fundraisers and not financial advisors…I’m not going to have a discussion with my donor about what they have or how to give…they should discuss this with their financial advisors…we have some information on our website.”

Frankly, I’m glad that the financial advisors have become involved with charitable planning. It is the wake up call to all charities to get trained, have the tools and knowledge in having meaningful discussions with their donors. These discussions will lead to meaningful discussions with the advisors for their donors which will lead to profound changes in funds raised for these organizations.

The competition for donations is as great as ever, even though the opportunity to discuss charitable giving with donors hasn’t changed over the years. The donors have always been there but the charities haven’t been there to discuss the best ways for their donors to give.

What has changed is the competition has become that much greater for charities and it’s not from other charities.

The challenge is that in the past ten years the charitable giving market has just become that much more competitive.

Financial advisors have now entered the market with Donor Advised Funds (DAF’s), Private Foundations and other tactics to create a greater stickiness to the investments that they manage for their clients. It’s not a bad thing that this has occurred since charities have always had this option but never pursued it.

In reality, the charities are doing all of the hard work in terms of engaging their donors, but these charities are content in receiving cash donations that are more expensive than a donation of appreciated stock (For a recap see our latest blog).

All of the galas, golf tournaments, special events, direct mail, and online giving does not come close to the potential of a well cultivated donation where a well trained or skilled charity staff or volunteer engages with their donor and illustrates the best ways to consider a donation.

Donors can give more at the same net cost if the donation is in the form of an appreciated asset like a stock or mutual fund.

Stock donation = tax credit + avoid taxable capital gains (all pre-tax dollars)

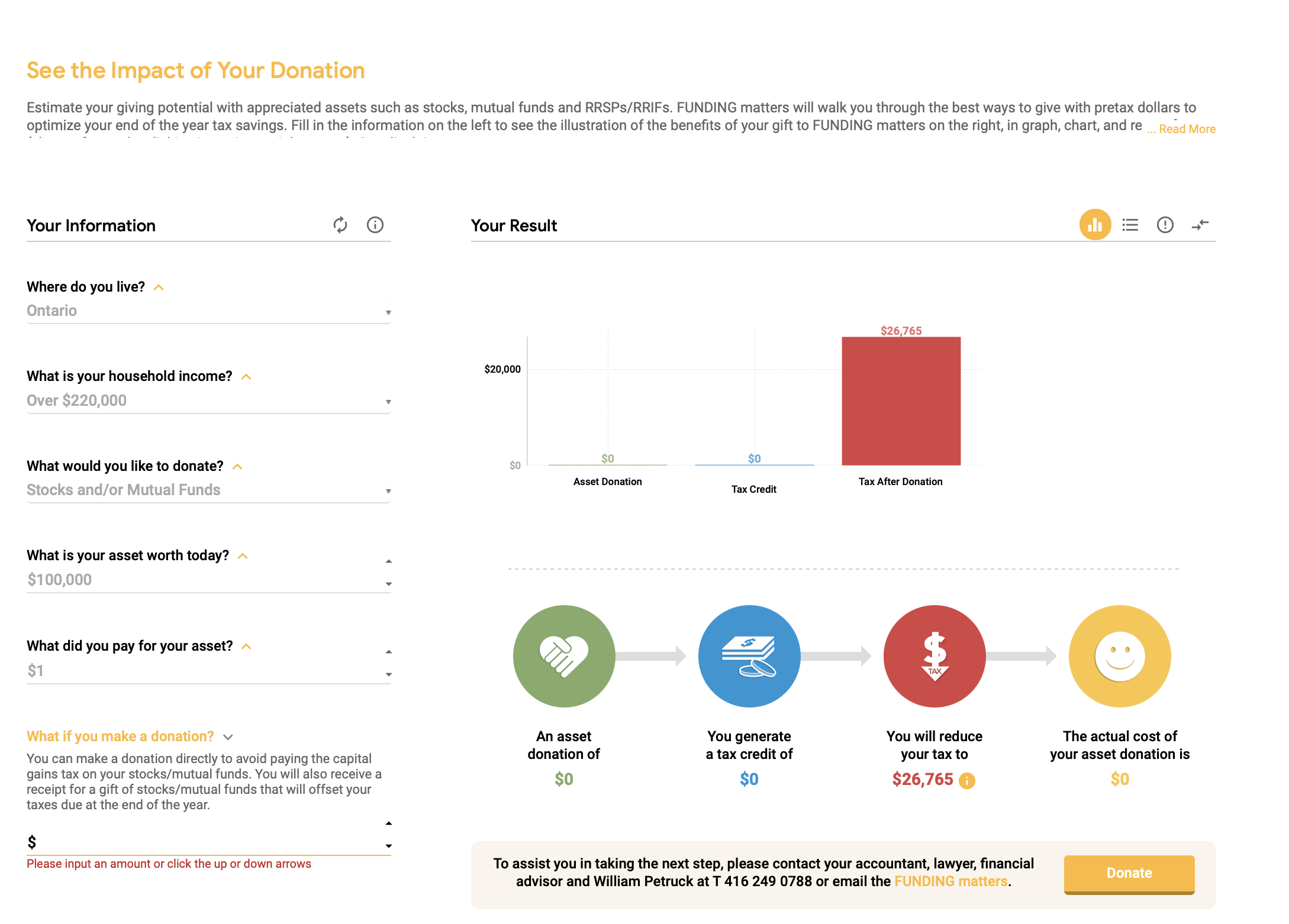

Tax on a $100,000 taxable capital gain = $26,765

Cash/Cheque/VISA = tax credit (and you’ve used after tax dollars)

In the image above, you will see how the Capital Gains on your Stock and / or Mutual Fund investment will increase your taxes. If you chose to not make a donation you would be owing $26,765 on your investment.

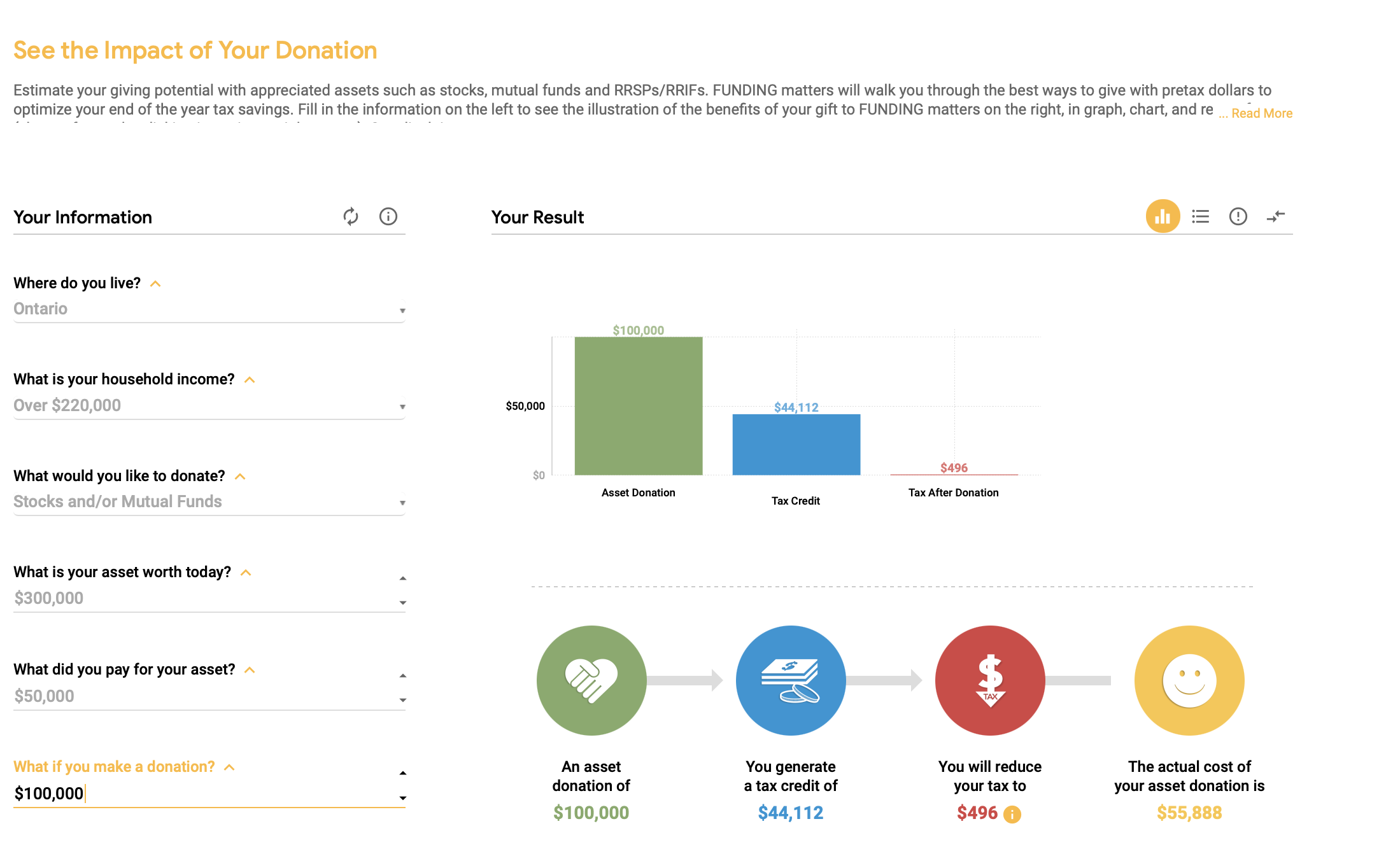

Here is a scenario where you could offset that same Capital Gains tax with a donation that will not only benefit a deserving organization but also help with your taxable income. By donating a portion of your Capital Gains such as $100,000 in this case above, you see how you can reduce your tax and generate a tax credit of $44,112 where your $100,00 donation only costs you $55,888.

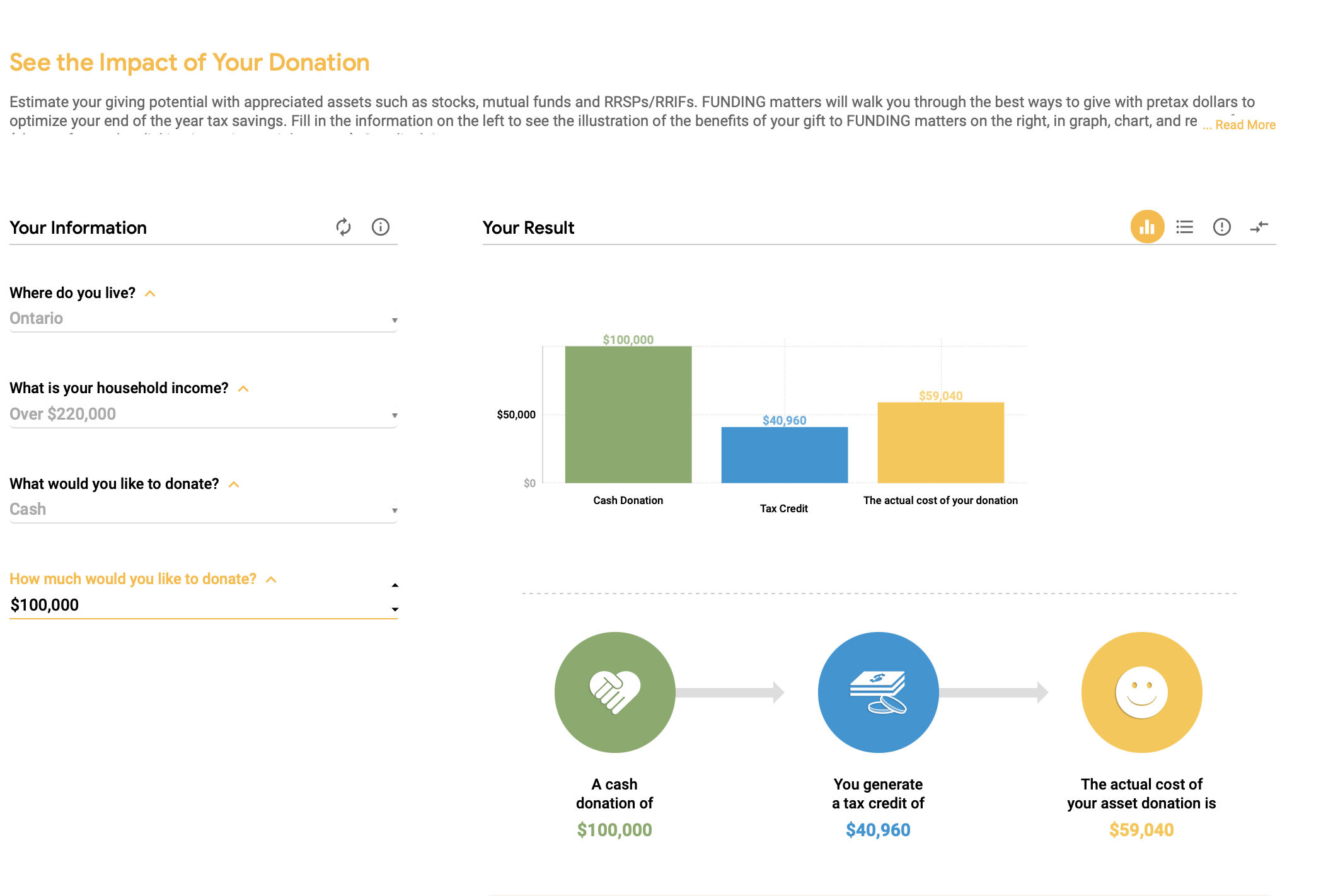

In the image above we see a case where the donation was made in cash. A $100,000 donation generates a tax credit of $40,960 costing you a total of $59,040.

Let’s create a win-win-win for the charity, the financial advisor and the donor.

- Give the charities and the advisors the tools the need to have informed and meaningful discussions with their clients and prospective donors;

- With the support of advisors, charities should engage in discussions with their donors to create endowed funding that support programming or operations; and

- A cooperative relationship between the advisors, the charities and the donors/clients can create opportunities for tax efficient giving.

I’d love to hear your thoughts, successes and challenges and how we can incorporate strategic philanthropy into your daily routine.

Happy Fundraising!

Bill

wpetruck@fundingmatters.com

416.579.0870