Asking for a cash donation may seem easier than a Major Gift, but is it the right thing to do for your organization?

When you ask for cash donations you really don’t need to put the time into helping your donors while they are trying to help you and your organization.

When you ask for cash you don’t need to put the time into becoming a competent advisor or one who is willing to spend time with donors and provide direction or connections to those who can assist the donors in making a wise donation decision.

When you ask for a cash donation you don’t really need to learn new things like asset based giving or options for giving.

When you ask for cash you’re not building the sustainability of your organization but meeting your current needs.

But asking for assets makes sense for your donor and for your organization.

When you ask for a cash donation you are asking your donor to give out of the smallest bucket that they have in the overall assets. Cash is an asset but so are stocks, mutual funds, real estate, art, tangible personal property and registered investments and even private business shares.

I am willing to bet that the cash holding for most of your donors is truly the smallest bucket of assets of all of their holdings.

Then why do you keep on taking the easy way out?

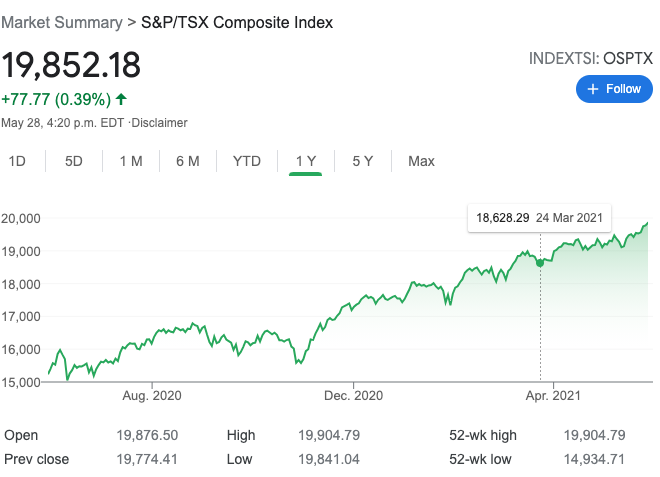

If you invested in the stock market over the past year, the gain represents an opportunity to discuss the advantages of donating shares to your charity rather than donating cash. The share donation is pre-tax thus eliminating the tax owed on the donated shares. Rather than donating cash where you’ve already paid the tax, your donation actually cost you more than if you donated the equivalent amount in shares.

In the Giftabulator scenario above, the donor lives in Ontario and has a household income of $91,101 which determines their tax bracket. Their shares are worth $25,000 and they paid $10,000 for them. Not a bad return on investment. The tax on the asset is $2,605. A Major Gift of $5,000 provides a tax credit of $1,968 and reducing the tax to $637. The actual cost of their donation when transferred from their investment account to the charity is $3,032.

Invest in yourself, invest in your organization, embrace new approaches to donor engagement, donor education and organizational sustainability.

For more information, please feel free to contact me.