With tax season upon us, it’s not enough to just organize the shoebox of last year’s receipts, slips, and notes for our accountant or our online filing program. We need to take stock of missed opportunities and plan for the current year.

The good news is that, with eleven months to go, charities and advisors have a valuable runway to engage in discussions with their donors and clients, and donors have the time to make a difference for themselves and their communities.

In an ideal scenario, a charity reaches out for funding armed not only with a strategy but also with the information needed by a prospective donor to understand and unlock their giving potential. The donor’s financial advisor also plays an important role by helping to reduce the donor’s tax exposure: in essence, helping the donor trade a donation in exchange for income protection.

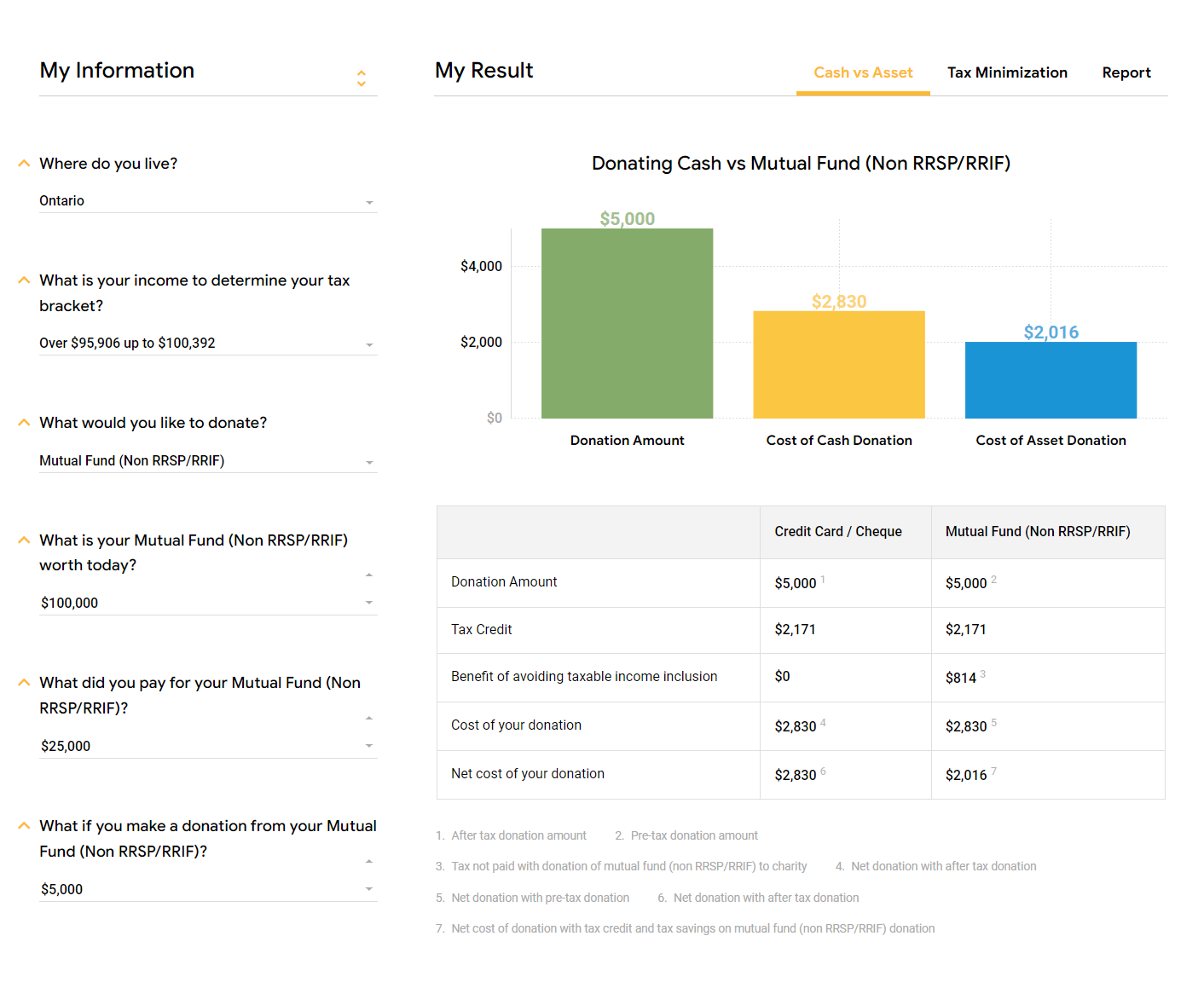

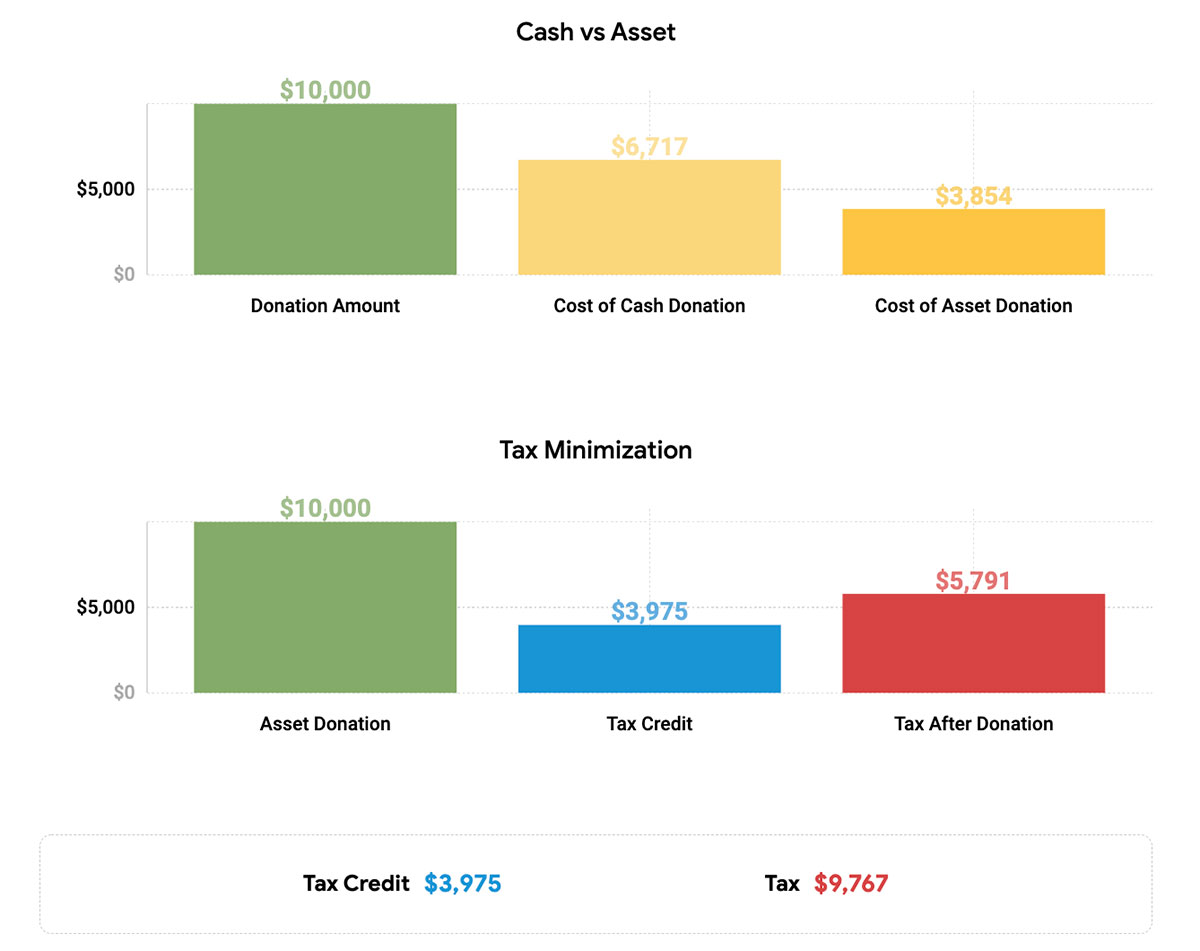

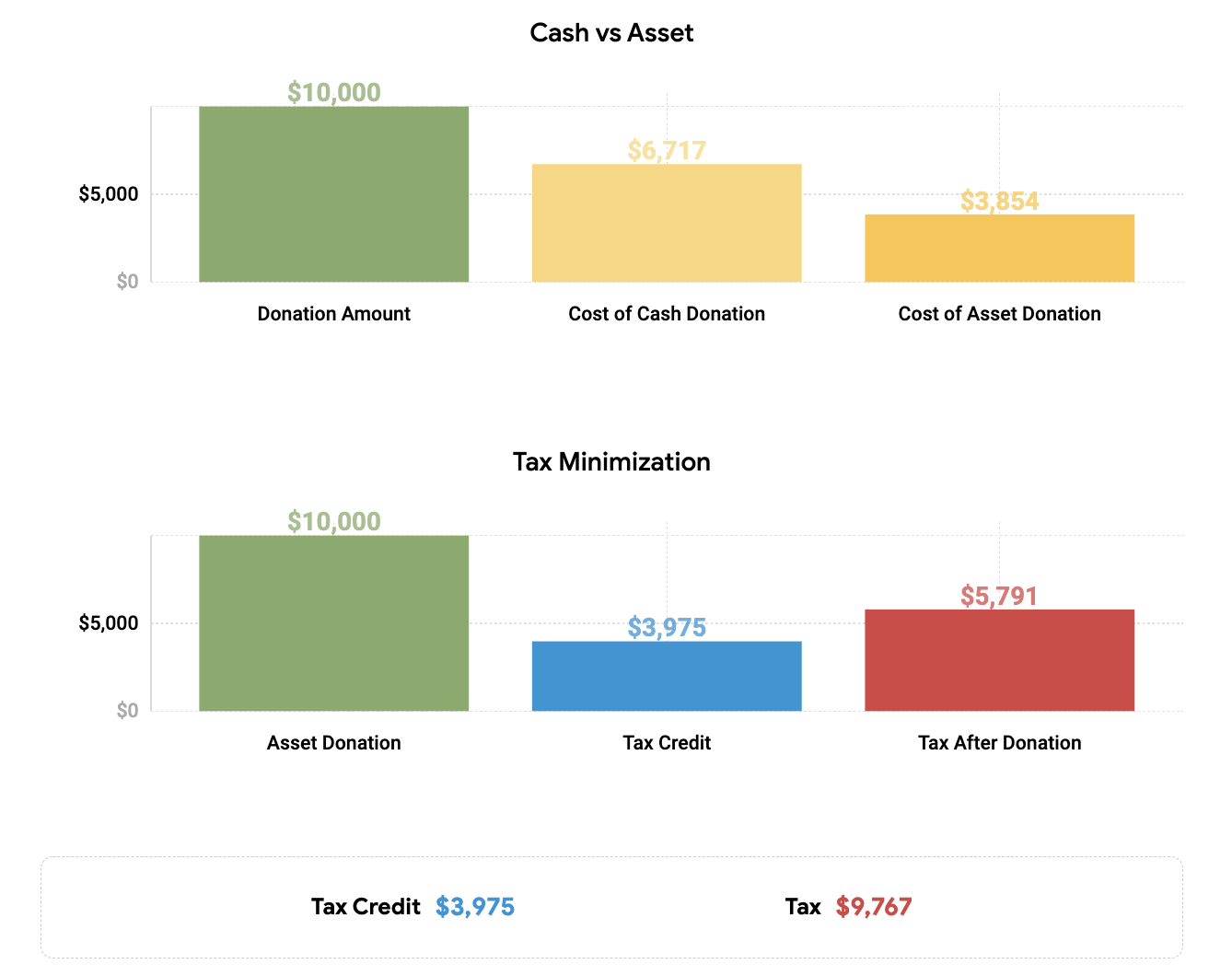

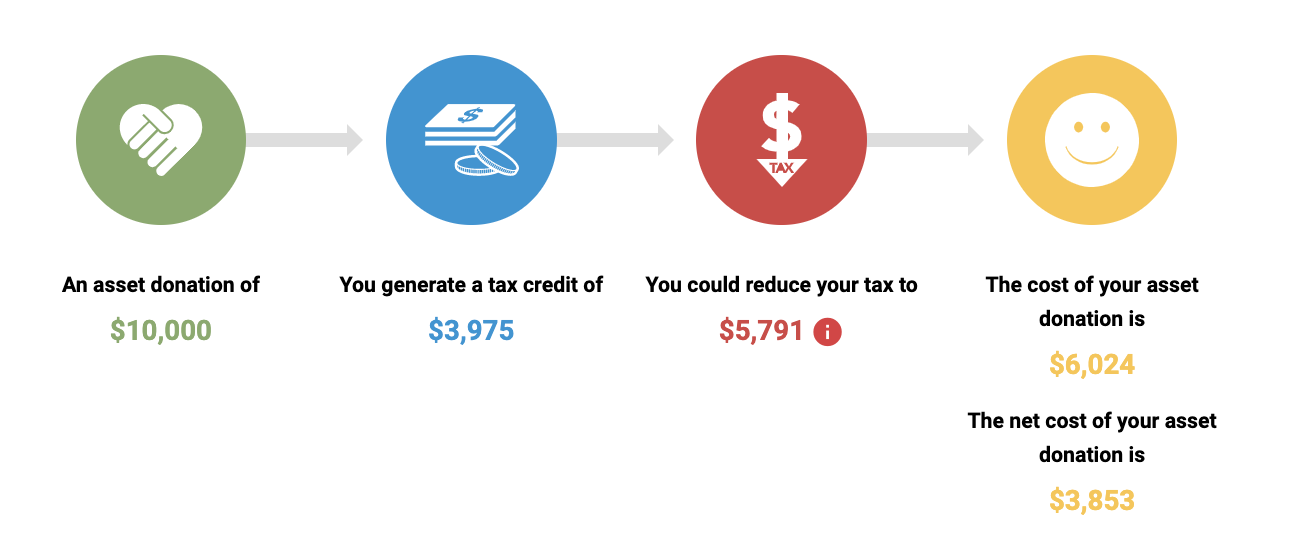

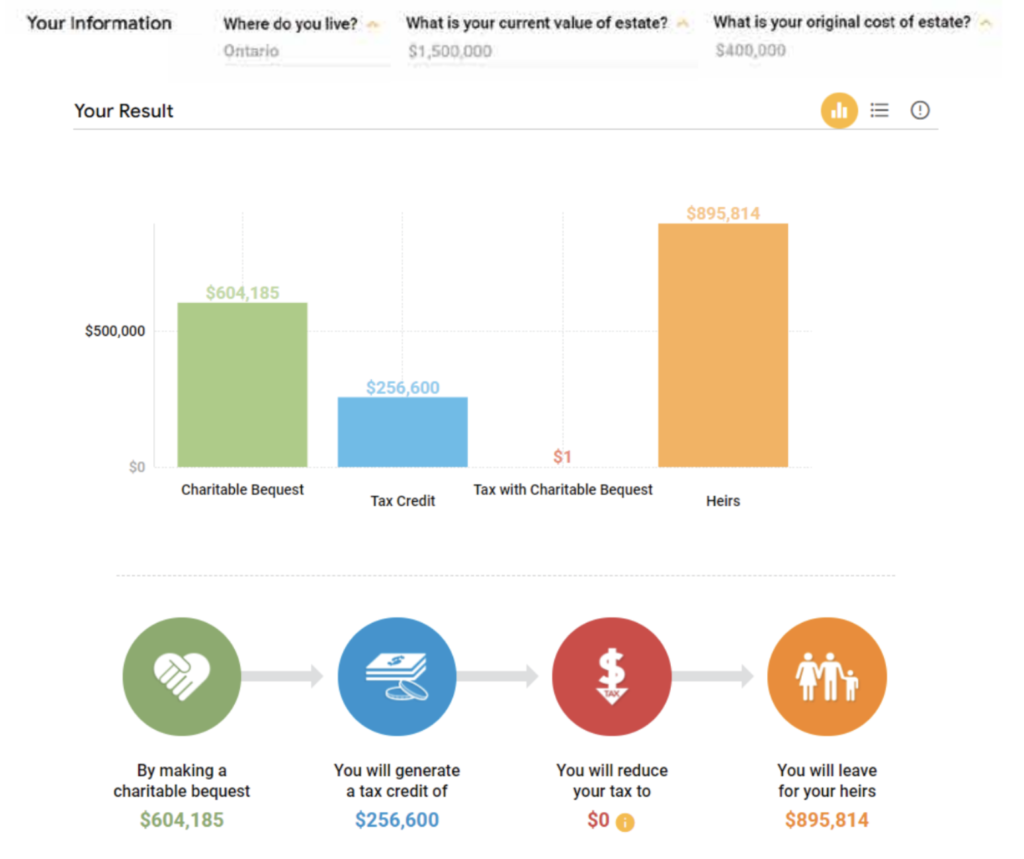

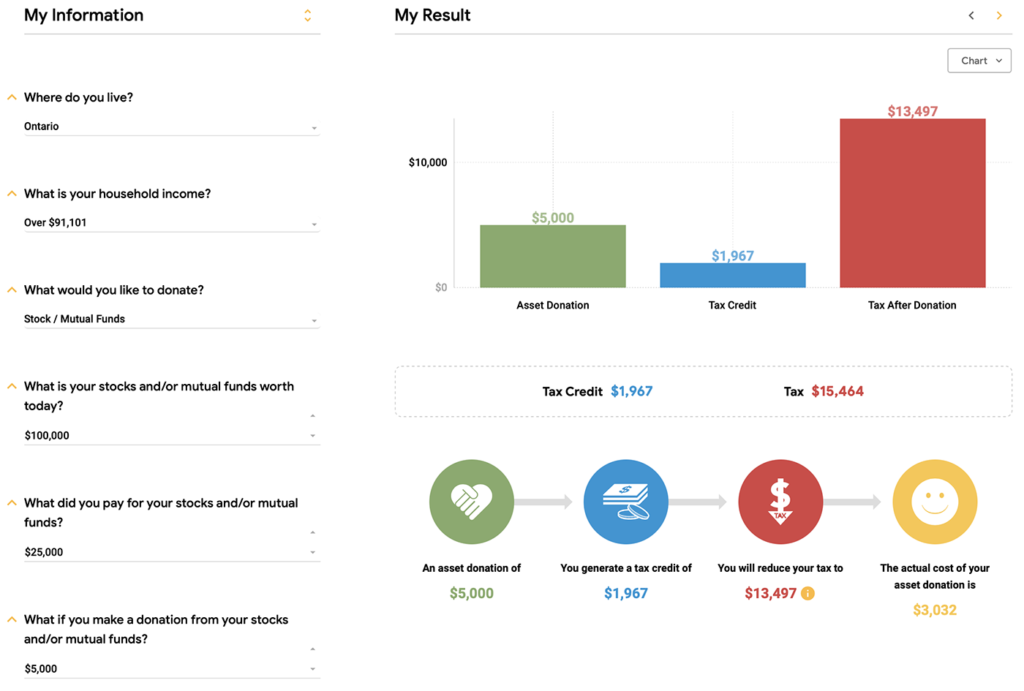

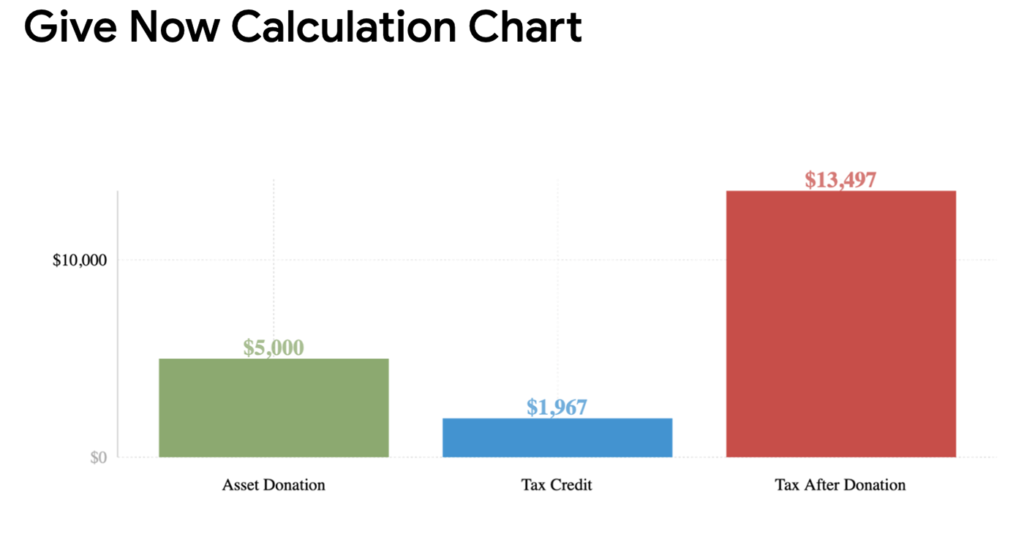

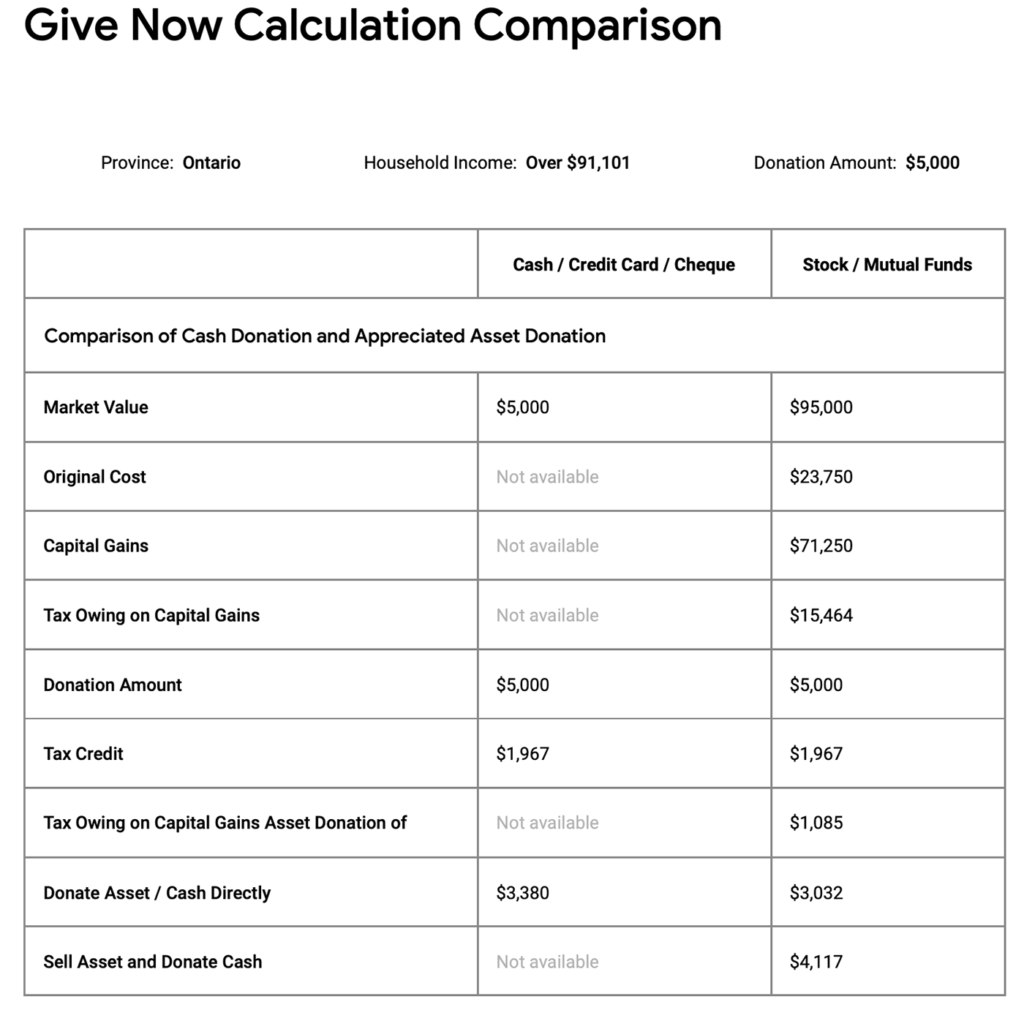

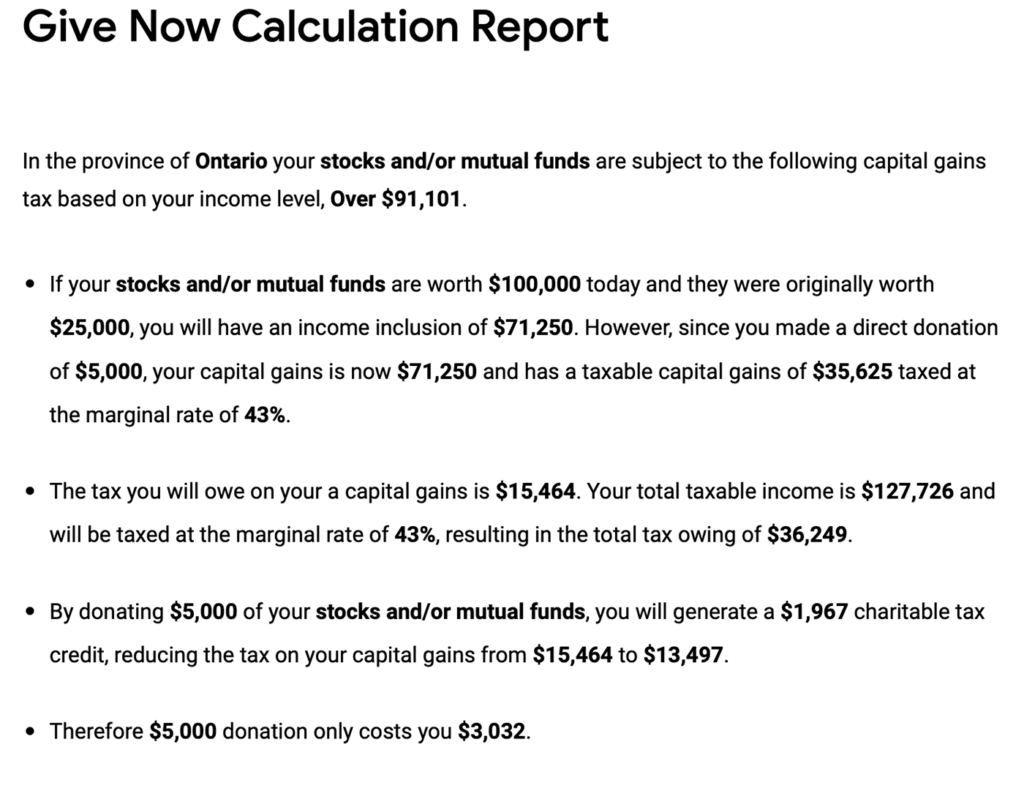

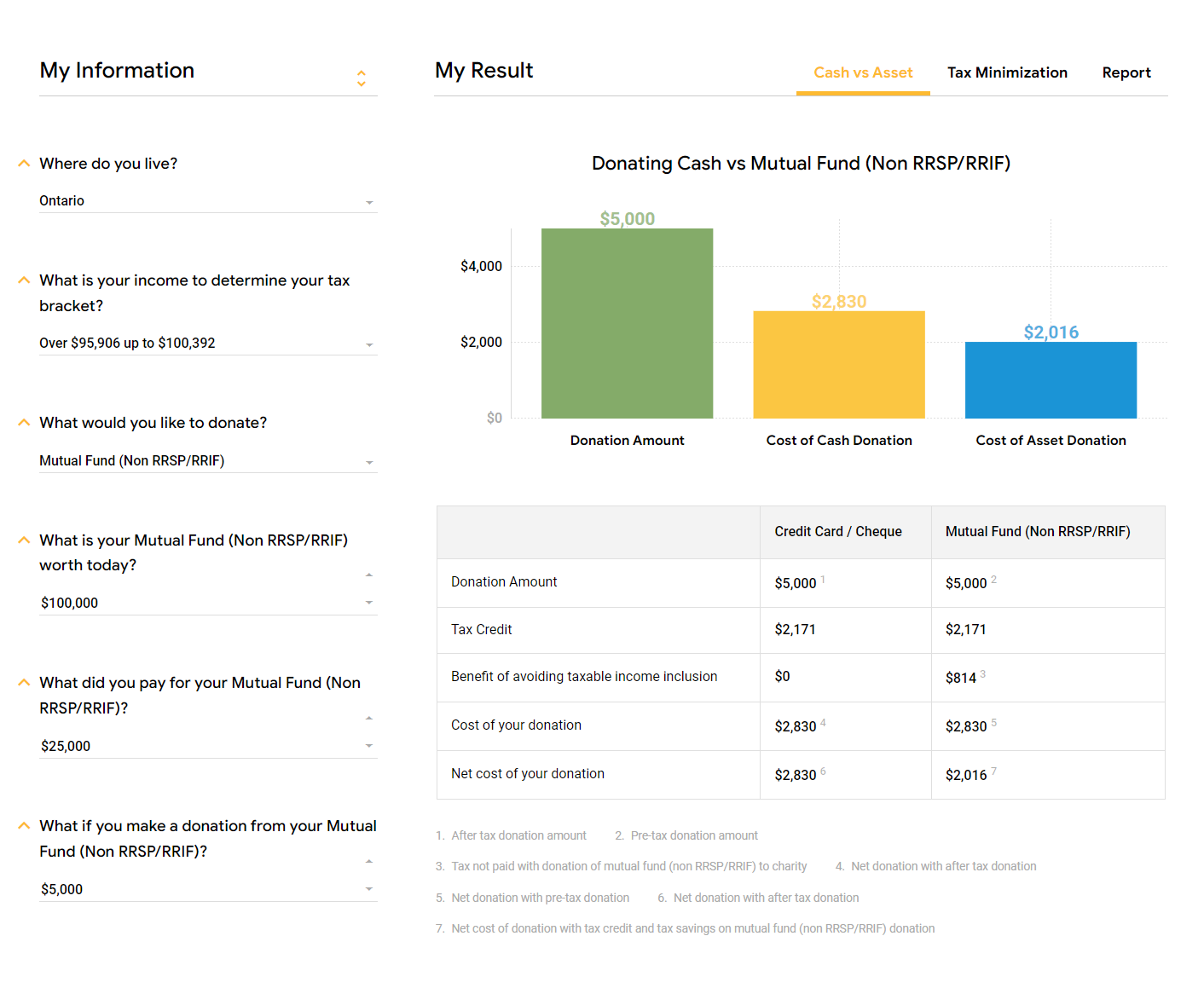

With the stock market hitting all-time highs, donors should be looking well beyond simply donating from their chequing account with after-tax dollars. Instead, advisors and fundraisers should illustrate the benefits of a donation from assets that will be taxed once sold. In this situation, the advisor transfers the donor’s shares to the charity, no tax is incurred on the capital gain, and the donor receives a tax credit for the donation. The result is a win for the client/donor, the charity, and the advisor.

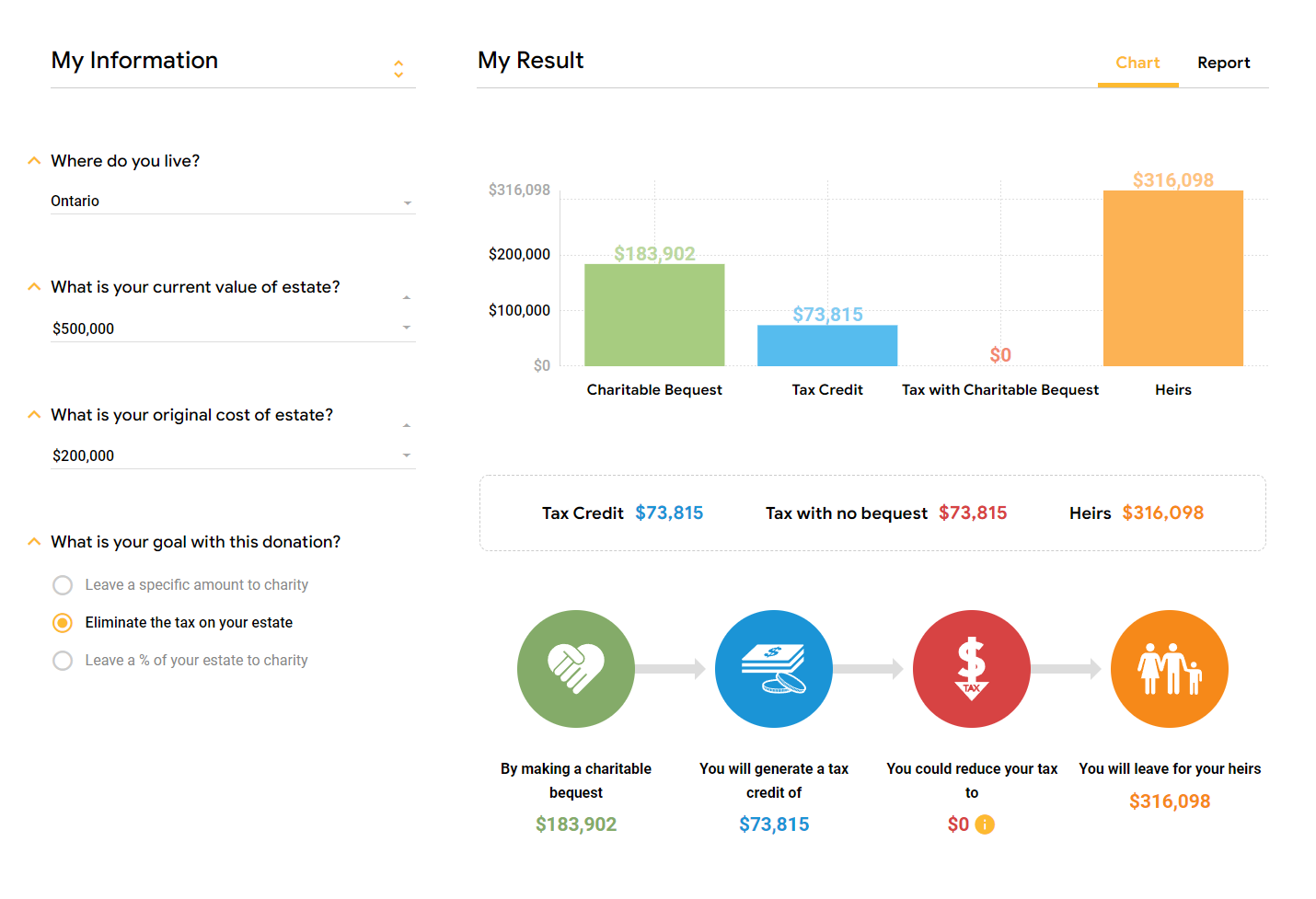

Bill Petruck, president of FUNDING matters® Inc., a consulting firm that advises charities on capital and endowment campaigns, and the developer of Giftabulator® – an online app that instantly illustrates the tax benefits of charitable giving from appreciated assets and estates – understands that planned giving can be intimidating. “Complex terms, complex calculations, and the risk of penalties if done incorrectly lead many fundraisers and financial advisors away from discussing planned giving strategies with their donors or clients, which in turn leads to expensive lost opportunities for all parties.”

Petruck knows many donors “could have given more in 2021 in order to save on taxes.” He developed Giftabulator® to make the concepts of major-gift and planned giving easier to understand. “When charities and advisors can teach the core capabilities of strategic philanthropy, they provide value to their clients and that translates to value for everyone.”

James Murphy, director of philanthropy at Thrombosis Canada, has seen the positive impact of introducing Giftabulator® to donors at health care institutions. “Giftabulator was instrumental in showing annual major donors how they could make significant tax-efficient donations from their stocks, registered retirement funds, and mutual funds without impacting their lifestyle or that of their future beneficiaries.” Murphy continues to implement Giftabulator® with Thrombosis Canada. “Tax planning and charitable giving are important to medical professionals, donors, patients who have benefitted from the best funded treatment, and financial advisors.”

It’s important to remember that charities play two primary roles: the first is to provide services, care, and programs that fill the large gaps that governments can’t or won’t fund in communities; the second is to raise funds for these programs and services.

Overall, charities excel at providing their programs and services with limited resources, day to day and year to year. It’s in the second role of fundraising that they often encounter challenges.

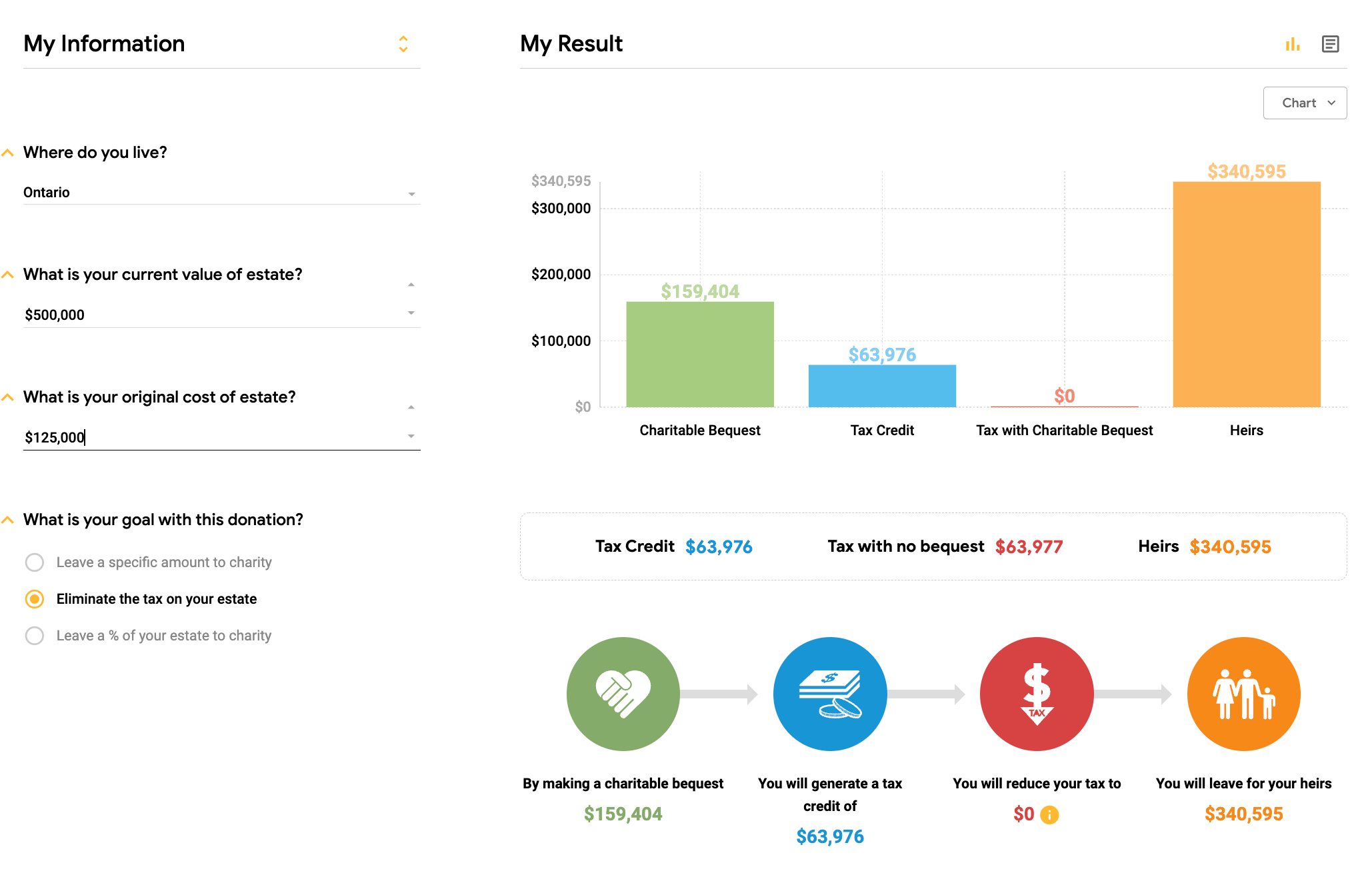

Petruck emphasizes that charities need to educate donors about endowing from the donors’ estate and current assets. “Rather than relying on a widely and often randomly focused fundraising appeal at the end of the year, both donors and charities would benefit financially from targeted discussions about the importance of donating – and from a tool that shows donors how they can afford a tax-efficient donation from taxable appreciated assets.”

Giftabulator® is pre-programmed with charitable giving scenarios based on region, household income tax brackets, and tax payable on appreciated assets such as stocks, mutual funds, registered investments, secondary property, and private company shares. It generates outcomes within a split second to illustrate the benefits of a charitable donation.

Trevor Parry, lawyer and president of the TRP Strategy Group, faults the current federal government for “funding their reckless spending agenda by accelerating a punitive taxation regime targeting entrepreneurs, professionals, and ordinary investors – in other words, the middle class. Strategic philanthropy is the synthesis of altruism and prudent tax planning. Taxpayers wishing to replace Justin Trudeau with loved ones as their primary creditor will be disappointed to learn this isn’t possible. Charitable giving, particularly by those with large, accrued capital gains in their businesses and portfolios, is the last remaining option in tax relief.”

Planned giving can revitalize a fundraising program. With the right tool and with informed, supported staff, charities can sustain their giving programs and improve the financial position of their donors.