No better time for in-kind donations

Surging markets and charities in need create a planning opportunity

By: Rudy Mezzetta | Source : Investment Executive

This article will appear in the December issue of Investment Executive.

High-net-worth clients holding appreciated securities in their portfolios are increasingly choosing to make charitable donations “in kind” rather than giving cash. This strategy enables those clients to avoid realizing large capital gains after a banner year for equities markets.

“With record markets and record prices on most securities, now is probably the best time that there has ever been to donate a portion of those [appreciated securities] to registered charities,” said Jamie Golombek, managing director of tax and estate planning with CIBC Private Wealth Management in Toronto.

As of Nov. 30, the S&P 500 composite index was up by 25% over the previous 12 months, while the S&P/TSX composite index was up by 19%.

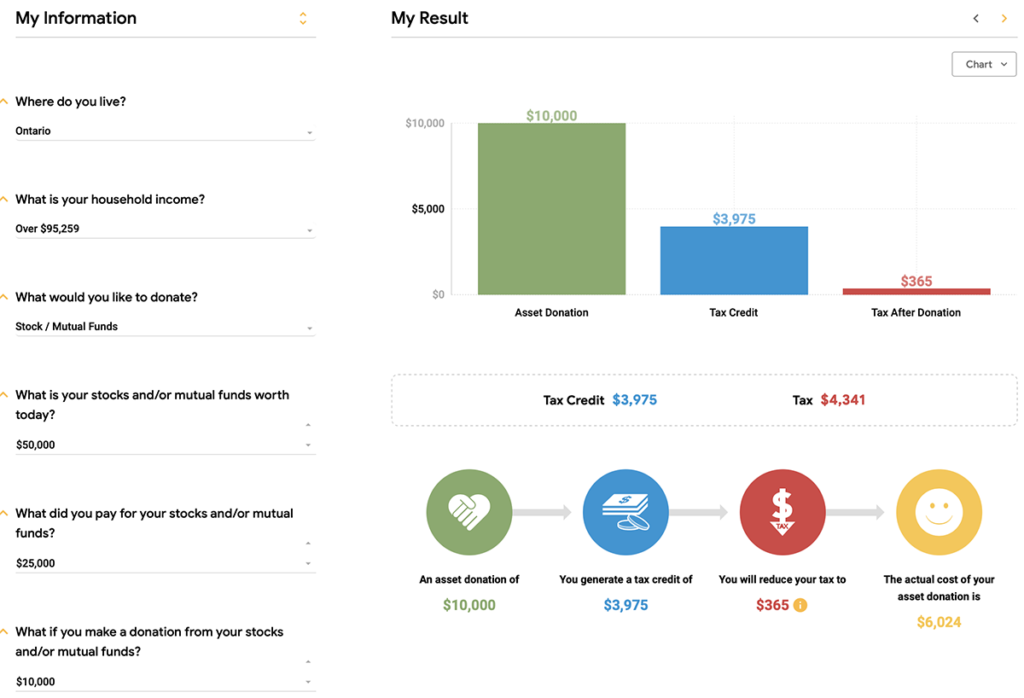

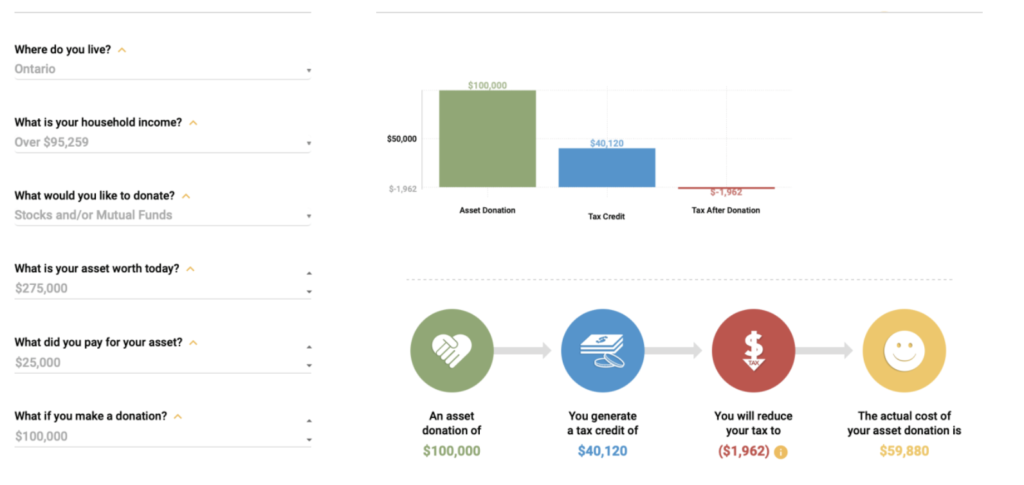

With an in-kind donation, a client receives a charitable tax receipt equal to the fair market value (FMV) of the appreciated security while also eliminating the potentially large capital gains taxes associated with selling that investment.

“[Clients are] saying: ‘I pay a lot of tax, I think tax rates are going to increase, and I really need to start managing and coming up with solutions for this because I’m worried about my tax bill,’” said Mark Skeggs, vice-president of wealth planning with Gluskin Sheff + Associates Inc. in Toronto. Charities’ needs have increased during the pandemic, he added, and clients want to support those organizations.

Individuals who donate publicly traded shares, mutual funds, ETFs or segregated funds in kind can achieve significant tax savings relative to selling the same investment and then donating the cash proceeds. For example, a client donating publicly traded shares worth $5,000, with an adjusted cost base of $2,000, would eliminate the taxes on the $3,000 capital gain, half of which would be included in income. For a client in Nova Scotia in the top marginal tax bracket, for example, an in-kind donation would save the client $810 compared with selling the same asset held in a non-registered account.

That client also would be eligible to claim federal and provincial non-refundable donation tax credits, just as they would for a gift of cash. If a gift is made to a charity before the end of the calendar year, the tax credit can be applied against taxes in the current year or carried forward for up to five years. Donation tax credits claimed can’t exceed 75% of a person’s net income in a taxation year, or exceed 100% on their terminal return or on the return for the taxation year preceding their death.

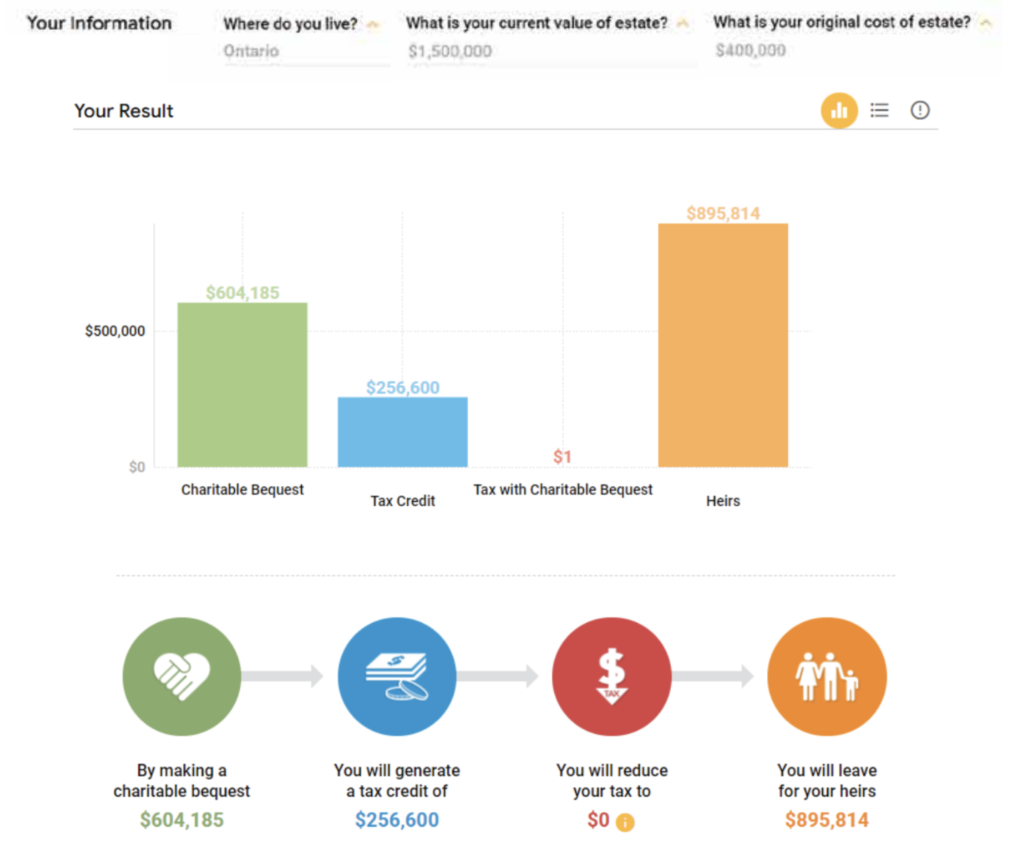

Malcolm Burrows, head of philanthropic advisory services with Scotia Wealth Management, said he’s worked with many older clients who have held stocks for decades and are “gobsmacked by the cumulative gains” and “terrified of the tax implications from selling.” These clients, Burrows said, often are open to donating these shares as part of their broader charitable giving and estate planning, which “enables, sometimes, quite significant donations.”

Financial advisors can raise the topic of charitable giving in general, and in-kind donations in particular, as part of year-end discussions with clients about rebalancing portfolios. One common strategy is for clients to donate a portion of an appreciated security in kind — enough so the tax credit associated with the donation will offset the capital gains taxes realized from selling the remainder of the position — and then to use the proceeds of the sale to rebalance.

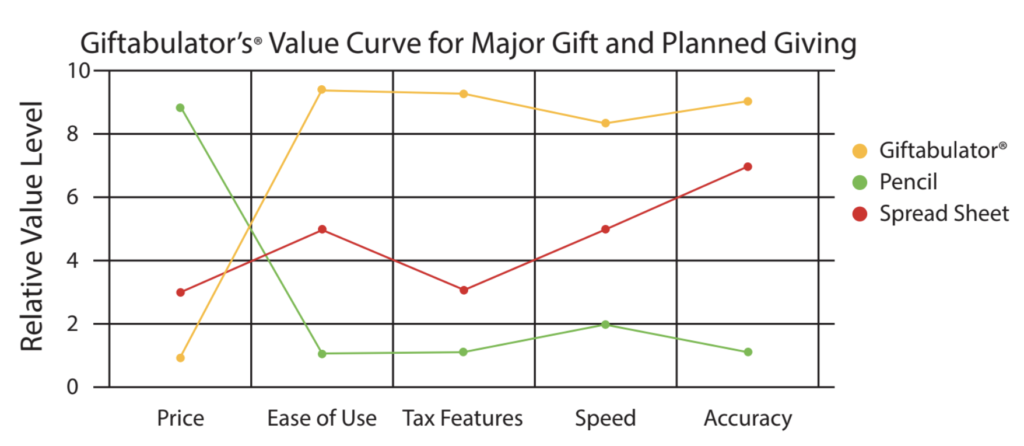

“People are saying: ‘I’ve given the government enough money. I really want to look at other opportunities for charitable giving and estate planning,’” said William Petruck, president and CEO of Funding Matters Inc. in Toronto, a charity consultancy firm that offers an online calculator for determining the most tax-effective way to make a donation.

Clients who wish to make a charitable donation but still want to hold onto a particular security can donate the security in-kind and then immediately buy it back with the cash they would otherwise have used to make the donation. This strategy allows for tax savings while maintaining the position in the client’s portfolio.

“There are superficial loss rules, but there are no superficial gain rules,” Skeggs said. “If it is a situation where it’s a stock that [a client] likes, that is a strategy we look at.”

Business owners can consider making in-kind donations from their private corporations rather than doing so personally, said Carol Bezaire, senior vice-president of tax, estate and strategic philanthropy with Mackenzie Investments in Toronto.

In-kind donations from a corporation generate a triple tax benefit: they eliminate the accumulated capital gain on the donated security; generate a charitable receipt for the FMV of the security, which results in a tax deduction for the corporation (as opposed to a tax credit for a donation made personally); and increase the corporation’s notional corporate dividend account (CDA) by an amount equivalent to the non-taxable portion of the capital gain. Amounts in the CDA can be paid out as tax-free dividends to Canadian-resident shareholders.

Bezaire said there has been “a big pickup” in business owners choosing to make donations from their corporation’s retained earnings to mitigate the effect of recent tax changes.

As of 2019, a corporation’s access to the small-business deduction is gradually reduced once the corporation’s passive investment income for the year is above $50,000 — and the deduction is eliminated entirely once passive income reaches $150,000. Many advisors, therefore, counsel their business-owner clients to make in-kind corporate donations to receive the deduction against income and “clear out [their] corporations so [they’re] below that $50,000 in passive investment income,” Bezaire said.

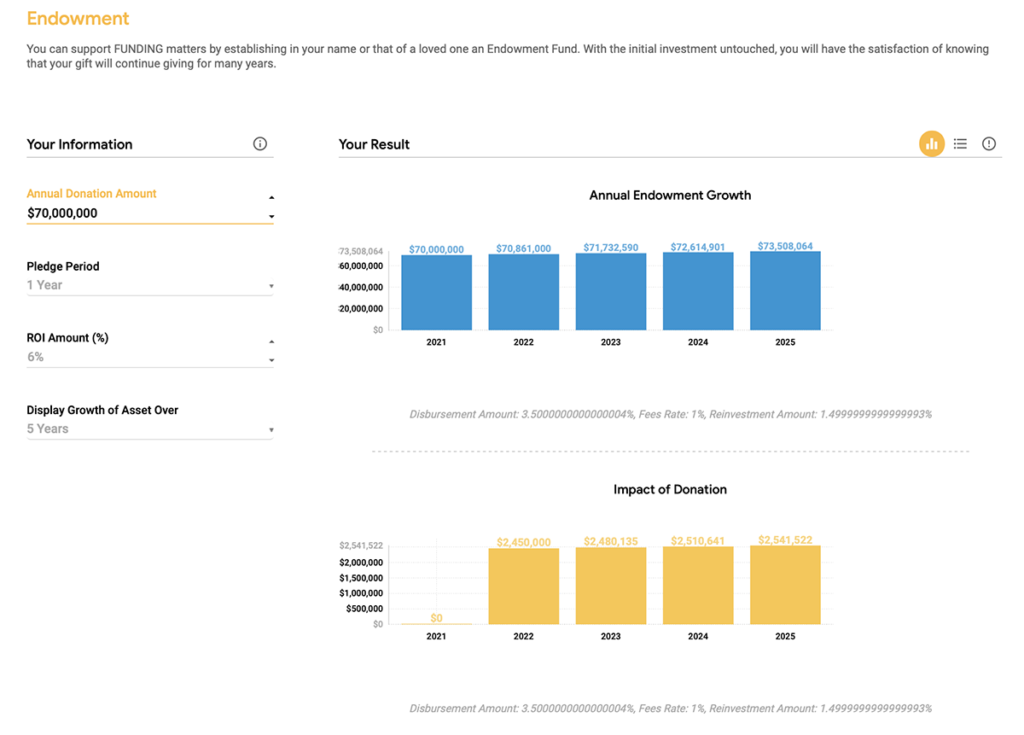

Clients unsure about which charities to support can consider giving to a donor-advised fund (DAF), a separate charitable account the client can establish as part of a larger charitable foundation, in order to receive a charitable tax credit for the donation, Golombek said. DAFs are required by law to disburse at least 3.5% of their assets each year to charity.

By making an in-kind donation to a DAF before year end, the client would eliminate the accumulated capital gains taxes on the security and receive a donation receipt that can be used on the current year’s tax return in order to claim the tax credit. “Then [the client] can decide, over the next 20 or 30 years, where the money [in the DAF] actually goes,” Golombek said.

Advisors who engage their clients regarding charitable giving during financial planning discussions may establish deeper connections with their clients as a result.

“When clients have [charities] that they want to support, there’s usually a story behind it, and usually it’s a very deep and personal [one],” Skeggs said. “Having these conversations just helps to enhance your relationship.”